What drives the market on April 7?

https://bit.ly/35CP6aO

07.05.2020

The main focus is on the UK as the Bank of England made an announcement this morning. Let’s see what’s happening with the British pound and what else moves the market today.

GBP

The pound surged higher after the BoE had reported that interest rates and quantitative easing would stay unchanged. Previously, the central bank maintained the interest rate at 0.1% and increased its bond-buying program by 200 billion pounds. Moreover, Boris Johnson, the British Prime Minister, promised to start reopening of the economy on Monday. As a result, the market sentiment turned positive and the British pound gained.

CNH, AUD

Surprisingly, Chinese exports rose by 3.5% while analysts expected the 11% drop. However, imports decreased by 14.2%, while only the 10% decline was forecasted. The overall sentiment after the report was positive that the second-largest economy may recover faster than anticipated, and the Chinese yuan jumped. Moreover, the Australian dollar gained on upbeat Chinese export data.

USD

Traders are waiting for tomorrow US unemployment rate, that is expected to be extremely high. Yesterday the ADP report revealed 20.2 million jobs lost that slightly exceeded the expected 20.5 million. That pushed the US dollar up.

Oil

The WTI oil price was growing up and then stopped on the $24 mark. As you remember, OPEC+ started to cut the oil production by 10 million barrels a day starting from May 1. It seems that the oil consumption is slowly recovering with the easing of lockdowns all over the world, but it may take a year to return to the pre-crisis level.

Please visit our sponsors

Results 331 to 340 of 370

Thread: Forex daily News FBS

-

07-05-2020, 02:06 PM #331Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

-

08-05-2020, 02:00 PM #332Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

What moves the market on May 8?

https://bit.ly/3bfRwxo

08.05.2020

Yesterday we got a poor data from the USA. There were 3.2 million new jobless claims, less than on the prior week, but more than analysts anticipated. That means, in total, it’s already 33.5 million people lost their jobs during the coronavirus. That’s terrible.

So, today we are waiting for non-farm payrolls at 15.30 MT time. It’s expected the worst ever. That means, Japanese Yen and Swiss Franc can gain against the US dollar today. However, if numbers are in line with expectations –USD could rally. The best you can do is to sell ahead of the report and close before or wait for the numbers to be released, prices to stabilize and see what becomes the real move of the day.

Now EUR/USD gains ahead of critical Non-Farm Payrolls. It recovered from 1.0765 yesterday and rose above 1.0800. There are several resistance levels on the H4. The pair has to rise above 1.0885 to get a chance to rise to 1.0965. Support is at 1.0775.

And now, for the good news, countries made first steps to reopen their economies, based on that, risky assets will continue to recover. The Australian and New Zealand dollars went up because of the encouraging Australian and Chinese trade data.

The pound also climbed. The Bank of England left its bond purchase program and interest rates unchanged, but they are ready to ease further. GBP/USD needs to rise above 1.24 for bulls to regain power.

S&P 500 futures hit their session highs after reports that China and the US had a phone call on trade. The yuan moved up.

Elsewhere, oil is benefiting from the improvement in the risk appetite. Yesterday the were wild price swings as investors weighed supply-and-demand fundamentals against Saudi Arabia’s global price hike.

-

12-05-2020, 02:08 PM #333Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

What do you need to know on May 12?

https://bit.ly/3fGVjr0

12.05.2020

Main movements on the market: risk-off mood strengthened USD, AUD dropped on China’s imports’ ban and Saudi Arabia cut oil production.

USD and stocks ahead of fear of the second wave

Today the market sentiment is quite risk-averse. There are some fears of the second wave of coronavirus infections. On the one hand, it’s awesome for the US dollar and the Japanese yen. On the other hand, it’s terrible for stocks, but not for all of them, the Nasdaq stock gained as biotech is in high need these days. Goldman Sachs expected that S&P 500 can contract by almost 20% in the next three months.

AUD fell under pressure of Chinese import ban

The Australian dollar went down after China had stopped imports of meat from four Australian producers, perhaps, it was the response to the Australian calls the COVID-19 outbreak inquiry.

AUD/USD has been moving up since March 23, but it seemed it takes a pause now. If it breaks through the resistant line at 0.653, it will continue increasing up to 0.667. However, if it crosses the support level at 0.64 it can fall further to the next support at 0.628.

Saudi Arabia announced cut of oil production

Oil stabilized after Saudi Arabia claimed it would reduce output. Saudi Arabia made a decision that it would further slash production, going beyond the OPEC+ agreement. Moreover, there are first signs of recovery of oil demand, that is also beneficial for the oil upper price.

The WTI oil price is slightly above the 50-day moving average. If it is strong enough to break through the 26.00 mark, it will open doors towards the next resistant line at 29. Support is 20.00.

-

13-05-2020, 02:32 PM #334Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Retail data for the US: down again?

https://bit.ly/35SUS8y

13.05.2020

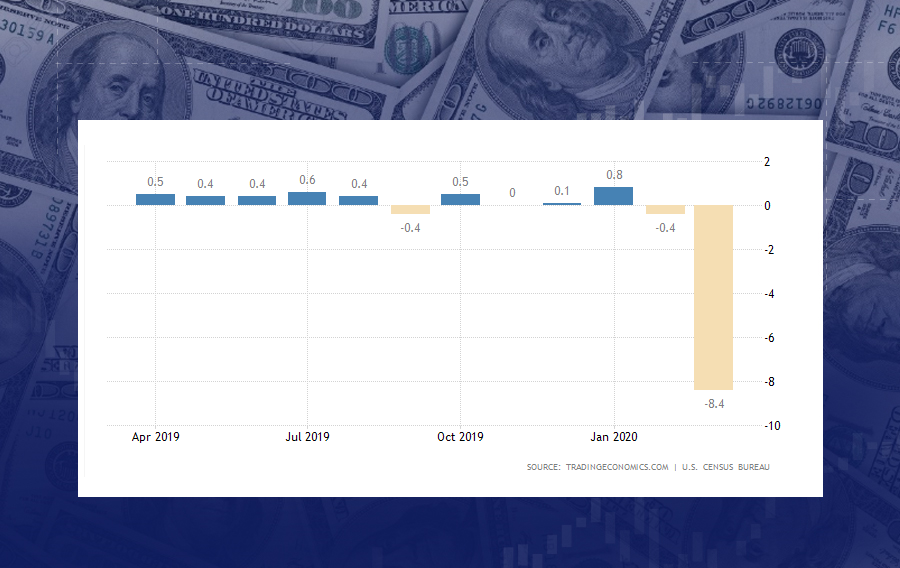

The US will publish headline and core retail sales at 15:30 MT time on May 15.

Instruments to trade: EUR/USD, USD/JPY, USD/CHF

While the headline retail sales show the total value, the core indicator excludes sales of automobiles due to their volatility. Based on their data, we may judge the economic activity of a country and the level of consumer spending. During the previous release, both indicators fell significantly. The headline one declined by -8.7% (vs. -8% expected). The core indicator surprised traders positively, though, if we may call it "positive". The indicator fell by "just" -4.5% (vs. the forecast of -4.9%). The pandemic hit US retailers hard as well as the US dollar. The greenback fell to the red zone on the release.Will we see a different outcome this time? There is a little chance that we do, but if that happens the US dollar will be a winner. Remember the simple rules:

• if the actual levels of indicators are higher than the forecasts, the USD will rise;

• if the actual levels of indicators are worse than the forecasts, the USD will fall.

-

14-05-2020, 02:36 PM #335Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

News digest on May 14

https://bit.ly/35SUS8y

14.05.2020

The market continues to be in a risk-off mode. Time to gain on falling!

AUD dropped on poor unemployment data

Almost 600,000 jobs were lost in April in Australia. Numbers were worse than analysts anticipated. As a result, AUD sank after its strong rally. Let’s look at the daily AUD/USD chart. The price has hit the 100-day moving average already twice. There is a still strong upward trend. However, no way AUD can break out this level soon in such a risk-averse market. If it manages to do it though, it will open doors towards 0.6635. Support are at 0.6375 and 0.626.

Trump disagrees with Powell on negative rates

The US president wants rates to go below zero, but Jerome Powell, the Fed chairman, doesn’t even consider this tool. Yesterday Powell claimed that outlook is dire and there are downside risks ahead. He thinks extra government spending will prevent the country from the long-term recession. The Fed also began buying exchange-traded funds to supply more money to the market and discussed additional aids. USD surged as well as JPY.

Stocks are overvalued

Stanley Druckenmiller, a billionaire investor, said that he didn’t remember the time when the risk of holding stocks so outweighed the potential profit. According to him, the market is flooded with liquidity and soon it will contract. Donald Trump, as always, impressed everybody with his straightforwardness.

However, Wall Street analysts don’t think the same. The S&P 500 has dipped this week, and economists expect the further downturn. Most analysts believe the market will be bearish this year.

Oil trades higher

The WTI oil price increased to $25 a barrel. Overall, it’s going up in May. It was caused by the drop in U.S. crude inventories, marking the first decline since January. However, analysts warn that oil prices could go negative again ahead of June contacts expiration.

-

20-05-2020, 02:14 PM #336Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Will the Flash Manufacturing PMI support the EUR?

https://bit.ly/2XcwTNG

20.05.2020

Euro Area Flash Manufacturing PMI will be released on Friday at 11:00 MT time.

Instruments to trade: EUR/USD, EUR/AUD, EUR/GBP, EUR/JPY

Similar to the same indicator in the UK, the Eurozone Manufacturing PMI’s drop in April was the steepest since its inception in 1997. From 44.5 in March it plunged to 33.4 in the next month. May’s Manufacturing PMI should be in the same spectrum noting the complicated state the European economy is in. Some countries still are experiencing local peaks of infection rates, others are struggling to keep the risk of the second wave of the virus at bay while the gradual economic reopening takes place. Therefore, it would be reasonable to expect the May Flash Manufacturing PMI in Europe to be comparably weak as in April. However, if it happens to positively surprise the market, the EUR will grow in value.

If the figure is better-than-thought, the EUR will rise.

Otherwise, the EUR will fall.

Check the economic calendar

-

21-05-2020, 02:07 PM #337Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Main market drivers on May 21

https://bit.ly/3d33ADG

21.05.2020

Let’s start with the stock market. The US-China relationship got worse and set a risk-off market sentiment. The US Senate claimed that it could bar Chinese companies from listing on American exchanges. While President Donald Trump tweeted criticism of China’s handling of the coronavirus outbreak. Everybody took it really seriously. As you can see on the chart S&P 500 has a strong upward trend, but after the swing up yesterday, it hit a 100-day moving average and contracted today. Support levels are at 2815 and 2705. However, if it breaks through the retracement at 2975, it will go up to 3000 and then 3110.

Let’s move on to the oil. May has brought some relief to the oil market. The worst of the demand drop seems to be over. The WTI oil price ticked up to $34 a barrel, while Brent crude rose to $36. Governments are easing lockdowns, and that’s boosting consumption. At the same time, Saudi Arabia, Russia and other OPEC members have started unprecedented oil production cuts, easing the massive oversupply. We haven’t seen such high prices since March 10. If it breaks through the resistance at 35, it may go even further to 37. Support levels are at 27 and 23.

And finally let’s talk about gold. The gold trades at high rates these days. We hadn’t seen any growth yesterday. The price was spiking high, but closed negative. That’s why we could assume that the price will move down in the short term, but the long term remains bullish. It could have a pullback to 1715 or even 1685 and then jump again.

-

22-05-2020, 03:02 PM #338Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

What moves the market on May 22?

https://bit.ly/3d17bCA

22.05.2020

China held out its hand to the US. Will the USA shake it?

The US-China relationship is the focus of attention these days. China pledged to implement the first phase of its trade deal with the US. According to Chinese Premier, “China will continue to boost economic and trade cooperation with other countries to deliver mutual benefits.” On January 15 two sides signed a phase-one trade pact, but the agreement has come under threat as Donald Trump blamed China for the coronavirus outbreak. According to him, he had “a very hard time with China” and he would “save $500 billion” if it cut off ties with China. Also, China for the first time since 1990 hadn’t set its GDP target. All this raised market uncertainty, S&P 500 fell deeper. Let’s look at the chart. The price had been rising since May 14, but it struggled to cross the retracement level at 2975. Now it’s headed down to the support level at 2895. It may be a good entry point to go short as if it breaks through it, the price will dip down to 2815.

JPY benefits from US-China tensions

As we know, both USD and JPY are safe-haven currencies. However, now the Japanese yen has an advantage as it stays outside US-China disputes. Also, today the Bank of Japan released a new lending program to support small businesses. That all played into Japan’s hands, the price of USD/JPY plummeted. Now the price is struggling to cross the 200-period moving average, which it has hit recently. If it breaks through it, it will fell down to 107.1. In other case, it may reach the retracement level at 107.725, that will open doors towards 107.9.

Oil is moving down

The risk-off sentiment on the market pushed the oil prices down. Victor Shum, vice president of energy consulting at IHS Markit in Singapore, said “the nascent demand recovery is still vulnerable, and the drop in prices today is an injection of reality”. Yesterday the WTI oil price had reached unseen highs since March 10. However, it bounced back today. Support levels are 27 and 23. Retracement is 35.

-

25-05-2020, 04:41 PM #339Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

What moves the market on May 25?

https://bit.ly/2LVxNbU

25.05.2020

Investors are confused. They weigh the prospect of a soon recovery as economies are reopening against the growing US-China tension. Also, analysts anticipate the whole trading to be discreet with US and British markets closed for public holidays.

Stocks gain

The risk-on mood still had a positive impact on stock indexes, such as S&P 500, Nasdaq and Dow Jones. S&P 500 has gained and approached the retracement level at 2975. If it crosses it, it will open doors toward the psychological mark at 3000. Support is at 2895.

Risk-on currencies are under pressure

Whereas, optimism around economic reopening is fading because of the lack of transparency in US-China relationships. Beijing decided to put security laws on Hong Kong, what was viewed negatively by the USA. Investors prefer safe-haven currencies to risk-on ones. AUD, NZD and GBP are moving down under pressure. Let’s look more closely at AUD/USD. It had been a strong upward trend since March 20. Nevertheless, the price has started falling on May 21. It’s may be just a correction. After the pullback to the support line at 0.649, it can move up again. Retracement is at 0.66. Support levels are at 0.649, 0.64 and 0.627.

USD vs JPY

The Japan’s government is expected to lift the state of emergency in Tokyo and its surrounding regions. The US dollar remains the most preferable currency among other safe-haven ones. It has even unbeaten the Japanese yen. USD/JPY has almost broken through the retracement level at 107.725. The next one is at 107.9. Support lines are at 107.35 and 107.1.

-

26-05-2020, 03:22 PM #340Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Market news on May 26: S&P 500 passed 3000

https://bit.ly/2X3A9w0

26.05.2020

Let’s look at main movements on the market today on May 26.

S&P 500 surged

First of all, S&P 500 passed the 3000 mark! The market sentiment is really risk-on today. It’s mainly based on recovery dynamics and potential drug developments. S&P 500 is headed to the next retracement level at 3110. Support levels are at 2960 and 2815.

GBP is moving up

Nevertheless, tensions between Washington and Beijing remain in focus as the USA added 33 Chinese entities to a trade blacklist without warning. It’s better to keep an eye on future developments in their relationship.

But, US-China disputes fail to weigh on risks as Donald Trump hasn’t yet pronounced the last word on the Hong Kong issue. The UK Prime Minister Boris Johnson announced the opening of all non-essential shops from June 15. All this played well for the British pound. It has just crossed the retracement level at 1.2265. Now it’s heading to 1.2315. Support levels are 1.22 and 1.216. However, analysts have bearish scenarios for pound in the long-term. Reasons are the end-June deadline to extend the Brexit transition period and the possibility of negative interest rates in the UK.

Oil demand is recovering

Let’s move on to the oil market. The WTI price approaches the retracement level at 35. The head of the International Energy Agency forecasted that the oil market will recover even before the global pandemic. According to him, the oil demand will rebound to its pre-crisis level in the absence of strong government policies, a sustained economic recovery and low oil prices. If the price breaks through 35, it will go further to 37.5. Support levels are 27 and 23.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Tags for this Thread

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

6Likes

6Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote