Did the Fed cause the US dollar to collapse?

The US dollar dropped after the Fed's statements about the duration of the normalization of monetary policy. During this process, the indicated currency risks losing its advantages as the main safe-haven currency.

On Wednesday, the US currency collapsed to its lowest level since November 2021. The main reason for this was the statements of Fed Chairman Jerome Powell, who allowed a gradual increase in interest rates amid the continuous high inflation in the United States. The regulator's management believes that it will take several months to make a decision to cut the central bank's balance sheet by $ 9 trillion.

In a similar situation, this currency found itself in a slight stupor state, trying to cope with the current losses. Powell's statements that the US economy "does not need aggressive monetary stimulus measures" exerted additional pressure. The central bank is ready to start normalizing monetary policy, but this process will take time. During the speech of the Fed chairman, the markets expected to find signals about the possible timing of the first rate hike. However, the situation remained unclear, as the head of the regulator stressed that the Fed did not focus on the timing of amendments to the monetary policy and did not make decisions on reducing the balance sheet.

The tension of the general background of the global financial market shocked the US dollar. On Wednesday morning, the EUR/USD pair was in the range of 1.1373-1.1374. At the same time, the Euro currency has slightly risen since the close of the previous session, in which it was trading at the level of 1.1364.

News are provided by

InstaForex.

Please visit our sponsors

Results 2,861 to 2,870 of 3458

Thread: Forex News from InstaForex

-

12-01-2022, 08:49 AM #2861

-

13-01-2022, 08:20 AM #2862

EUR/USD: Euro's gradual movements are more effective than the US dollar's surges

The US currency, which has fallen again after some macro statistics, finds it difficult to maintain balance in the EUR/USD pair. On the other hand, the euro is having a hard time keeping up with the US dollar, so it prefers to move slowly but surely towards achieving its goal.

Currently, the market is evaluating the US inflation data released yesterday. According to the report, consumer prices in the country in December 2021 increased by 0.5%, accelerating to 7% year-on-year. The key index gained 0.6% over the month, rising to 5.5% year-on-year. As for the prices excluding energy carriers and food, more than 1.7% was added in three months.

Based on the data obtained, economists concluded that high inflation penetrates into the very core of the economy. In this situation, the Fed has no choice but to raise interest rates in March 2022. The regulator fears not only soaring inflation but also the "overheated" US labor market. The Fed officials consider high inflation a significant threat to a full economic recovery, so they are ready to raise interest rates since there is no longer a need for emergency monetary support.

As a response to the published macro data, the US dollar sharply declined. It is worth noting that the EUR/USD pair passed through the upper border of the range 1.1200-1.1350 again before the release of the report. To date, the upward movement of the pair continues. The EUR/USD pair rose by 0.5% immediately after the release of inflation data, leaving the level of 1.1400 behind. On Thursday morning, it was trading at the level of 1.1444, trying to break new borders.

News are provided by

InstaForex.

-

14-01-2022, 08:17 AM #2863

US dollar is trying to resist the decline amid statistics and high inflation

The US currency has to fight the collapse again at the end of the week, resisting the negative impact of several factors, including the problem of macro statistics. Nevertheless, experts are confident that it will recover without much loss.

For a long time, this currency remains hostage to high US inflation. It can be recalled that the December macro statistics showed the highest core inflation over the past 40 years. The recent US CPI excluding food and energy in annual terms was 5.5%, which is higher than November's 4.9%. Current macro reports have shown that the expectation of the Fed's decisive action has reached a peak. The current situation practically sharply affected the US dollar, which is trying to resist the impact of negative factors.

It has now suffered significant losses, including a key technical breakthrough in the EUR/USD pair. On Thursday, the classic pair broke the resistance line around 1.1386, which limited the actions of the EUR/USD pair since November 2021. The reason for this is the sharp weakening of the US currency, recorded after the release of the December CPI. On Friday morning, the EUR/USD pair was trading at the level of 1.1477, trying to keep its won positions.

Experts consider the level of 1.1500 to be the next important resistance area for the pair. This is the previous low of the EUR/USD pair recorded before its massive collapse last November. The current situation is much the same. Today, the US dollar hit its biggest weekly drop in eight months. The reason for this is a sharp reduction in long positions on the USD and the markets taking into account several Fed rate hikes in its price.

According to analysts, expectations of decisive action from the Fed do not matter much for the US dollar. Earlier, the US currency collapsed amid a sharp rise in the price of a number of commodities. The only "trump card" it has now will be another search for a safe haven if risk sentiment changes dramatically. The dynamics of this currency are significantly affected by inflation, and most often negatively. The Fed keeps the need to outpace its growth, and this tension has a negative impact on the American currency.

However, many experts are optimistic about the US dollar's medium and long-term prospects. Specialists believe that it will systematically strengthen, alternating ups and downs. Analysts summarize that this is facilitated by the continued growth of commodities and the global asset market.

News are provided by

InstaForex.

-

17-01-2022, 09:03 AM #2864

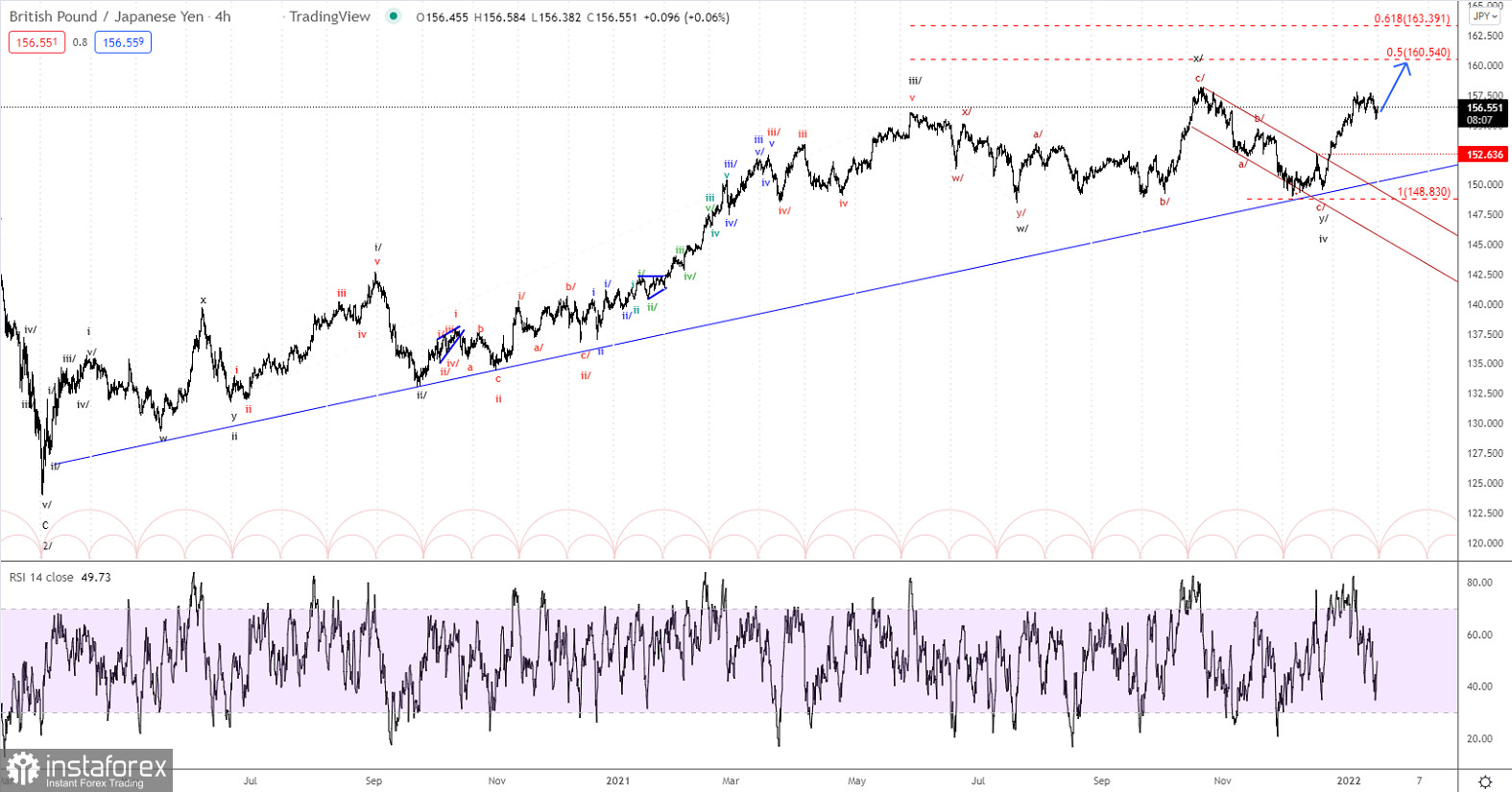

Forex Analysis & Reviews: Elliott wave analysis of GBP/JPY for January 17, 2022

The corrective consolidation is now complete and the underlying impulsive rally higher to our first target level of 160.54 is taking place. If bulls assert strength, GBP/JPY may go higher to our second target level of 163.39.

Keep the focus on the upside and a break above minor resistance at 157.69 for a continuation towards 160.54 and maybe even higher.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided byInstaForex.

-

17-01-2022, 09:15 AM #2865

Musk says Tesla to accept dogecoin

On Friday, Musk announced on Twitter that Tesla Inc would accept Dogecoin as payment for its products, such as the Giga Texas belt buckle and mini-model electric cars.

The news sent the value of Dogecoin soaring more than 14%. The move comes a month after Musk said Tesla would test out the digital token as a payment option.

Musk had already hit Bitcoin prices hard in the spring of 2021 with the same announcement, promising that the company would accept Bitcoins to buy its cars. However, he later changed his mind. So, some analysts believe this is Elon Musk's way of covering up the slump after the postponement of Cydertrack.

Thus, production of Tesla's much-anticipated Cybertruck will start in the first quarter of 2023, pushing back plans to start production in late 2022.

However, Tesla products, including the recently launched Cyberwhistle and Cyberquad for Kids, have been in steady demand and typically sell out within hours of being put up for sale, even when paid for in regular currencies. But some analysts are predicting a new surge in popularity for Tesla merchandise once token payment is introduced.

Due to Musk's tweets about Dogecoin, the little-known digital currency, which began as a social media joke, has become one of the most recognizable and well-growing tokens. Its price has risen by around 4,000% in 2021.

Last year, Tesla said it had bought $1.5 billion worth of Bitcoins. Musk also mentioned that he had Bitcoins and Dogecoins. However, as early as May, it was revealed that Elon had gotten rid of many cryptocurrency assets. This information confuses investors.

This may be an attempt to put competitive pressure on rivals, as traditional carmakers such as Ford Motor Co, as well as start-ups including Rivian Automotive, are set to launch their electric cars this year.

However, it is not yet clear how this trade move will be received by lawmakers, who have recently become concerned about crypto regulation.

News are provided by

InstaForex.

-

18-01-2022, 07:40 AM #2866

Stock markets up as China lowers interest rate

On Monday, global stock indices posted robust growth on positive news form China. It was reported that the People's Bank of China lowered its key interest rate in an effort to support the country's struggling economy. Today, the US stock market is closed for Martin Luther King Jr. Day. Therefore, trading activity in Europe and China was rather low. Despite this fact, major stock indices still managed to reach local highs and lows.

Thus, China's stock market closed the session with notable gains: the Shanghai Composite Index jumped by 0.6% to 3,541.7.

Dalian Haosen Equipment Manufacturing Co Ltd and Beijing Baolande Software Corp. topped the list of best performing shares.

The shares of Jiangsu Bioperfectus Technologies Co Ltd and Beijing Hotgen Biotech Co Ltd. Were among the losing ones.

A confident rise in the SSE Composite Index is attributed to higher-than-expected growth of the country's economy in the last quarter of 2021. At the same time, according to the National Bureau of Statistics of China, its GDP in Q4 was the lowest since mid-2020 (+4%).

In the third quarter of 2021, China's economy expanded by 4.9% compared to the same period in 2020. This was the reason why the central bank of China has unexpectedly cut its interest rate. Market analysts expect that in 2022 the measures taken by the central bank will help protect the economy against a significant slowdown.

As a reminder, at the beginning of 2021, the Chinese economy showed a steady rise after the coronavirus crisis. Yet, falling consumption in the last quarter of 2021 limited the pace of recovery.

Meanwhile, European stock markets opened another trading week in positive territory. Again, the data from China served as the main growth catalyst.

At the time of writing, the STOXX Europe 600 index increased by 0.35% to 482.8, the French CAC 40 added 0.42%, the German DAX rose by 0.22%, and the British FTSE 100 Index gained 0.61 %.

The worst result was posted by the largest food manufacturer - Unilever: its shares lost 6.7%. Meanwhile, the Swiss financial conglomerate Credit Suisse Group AG also showed a noticeable decline in share prices (-2.1%).

Among the leaders were Spanish bank Banco Bilbao Vizcaya Argentaria, S.A., with a rise of 0.5%, and European airline group Air France-KLM, whose shares added 0.8%.

According to analysts, the policy of China's central bank and its effect on the global economy will remain the main driver for markets this week.

Meanwhile, investors are looking ahead to earnings reports from the largest US corporations. Goldman Sachs will publish its data on Tuesday, Bank of America, Procter & Gamble – on Wednesday, and American Airlines and Netflix – on Thursday.

News are provided by

InstaForex.

-

19-01-2022, 08:01 AM #2867

Will the euro sharply rise again?

The Euro continues to compete with the US dollar, trying to leave the outsider levels. However, these attempts are most often unsuccessful. The euro's short-term growth does not have a significant impact on its overall pessimistic mood.

Over the past year, the price of the EUR/USD pair has declined by 6.9%. The weakest link of the pair, which is the Euro currency, got the most blow. Experts said that the euro should not count on major achievements this year. Its weakness contributes to the excessive caution of the European regulator.

Currently, the Fed and other central banks have expressed their readiness to normalize monetary policy as soon as possible. Experts stressed that this contrasts sharply with the ECB's inaction. This strategy of the European regulator contributes to the further decline of the euro and increased inflation.

Markets have high hopes for the upcoming changes in the Fed's strategy, which include cutting stimulus and raising the key rate. The currency market is now under pressure from the growth of the USD and the increase in the yield of US Treasury bonds. The US dollar's strengthening prevents the euro from rising, but the latter does not give up.

Moreover, the growth of the yield of US government bonds supports the US currency before the Fed meeting. On Wednesday, it strengthened its position after a sharp rise in the yield of US government bonds. Markets are waiting nervously for the Fed to raise interest rates, and this sends the EUR/USD pair to new frontiers.

In the current situation, the pair found itself under bearish pressure, while the US currency strengthened amid the rising treasury yields. On Tuesday, the EUR/USD pair managed to reach the level of 1.1400, but further gains stalled. Experts said that the pair failed to develop an upward movement. On Wednesday morning, the EUR/USD pair was trading at the level of 1.1331, trying to rise higher, but failed.

News are provided by

InstaForex.

-

20-01-2022, 10:06 AM #2868

Pound's growth contains a downward reversal

Experts found signs of a downward movement in the dynamics of the British currency, which rapidly increased after the publication of economic data in the country. Analysts say that a potential reversal to low values will create a price fluctuation for the pound.

At the end of 2021, the pound rose intensely after the Bank of England's interest rate hike. This year, the British currency tried to stay in an upward trend, acting with varying success. Analysts are afraid of negative changes in the dynamics of the pound, which the British regulator is able to influence. The revision of the current monetary policy is possible after the release of disappointing macro data on the UK economy.

News are provided by

InstaForex.

-

21-01-2022, 11:36 AM #2869

Employment reports do not meet the expectations of the Fed and the markets

According to the reports, the total number of Americans who applied for unemployment benefits exceeded a three-month maximum. Experts believe that the latest wave of COVID-19 infections is to blame, which has disrupted only the revived business activity, signs of revival of which are showing job growth.

Employment reports do not meet the expectations of the Fed and the markets.

Despite increased labor demand, initial jobless claims rose 55,000 to a seasonally adjusted 286,000 for the week ended January 15. This is the maximum since mid-October, which was reported on Thursday by representatives of the Ministry of Labor. The overall increase was the largest since July last year.

"Even with the usual buzz in the numbers, they seem to reflect the record increase in COVID-19 cases from Omicron," said Robert Frick, corporate economist at the Navy Federal Credit Union of Virginia.

"Fortunately, Omicron is at its peak, and if past models persist, applications should decline rapidly in the next two to three weeks," he said.

In the meantime, economists are disappointed, as the median forecast fluctuated at the figure of 220,000 applications for the last week.

Unadjusted benefit applications declined last week. However, this decrease was less than expected (taking into account seasonal factors that the government uses to exclude seasonal fluctuations from the data).

Applications increased by 6,075 in California. But they fell by 14,011 in New York. There were also big drops in Missouri and Texas.

The United States reports an average of 732,245 new cases of omicron coronavirus infection per day, according to official government data. However, there are signs that in some regions, including hard-hit New York, the number of cases is beginning to decrease.

Applications may begin to decline as the number of cases of infection decreases.

And yet it may not just be a seasonal outbreak.

Thus, conditions in the labor market are tightening. Employers are in desperate need of workers: 10.6 million vacancies were opened at the end of November.

But what if some of these vacancies have unadjusted wages for inflation? It is known that wage growth always lags behind inflation. Taking into account the huge migration of employees noticed in December last year, it is possible that the most "delicious" vacancies were dismantled, leaving former employers with empty jobs. How competitive are these 10 million vacancies? This hidden factor does not allow us to estimate the actual capacity of the employment market.

Currently, the unemployment rate is at a 22-month low of 3.9%, which is a sign that the labor market is at or close to maximum employment. The question remains, where do 10 million vacancies come from if the real sector is going through hard times due to supply disruptions and the rise in the cost of components?

Recall that in December, the economy added 199,000 jobs, which is the lowest figure for the year. This shows that the economy has slowed down the recovery. At the same time, the last two years have "taken away" 2.2 million able-bodied residents from the United States. Given the weak reflation, it is not entirely clear why there is such a stir around the search for labor?

The application data covers the period during which the government surveyed businesses for the non-agricultural component of wages in the employment report for January. At first glance, applications significantly exceed their level in mid-December. However, the actual conditions may differ from those described in the application.

Along with this obvious discrepancy between the two indicators, experts note that the shortage of workers and disruptions caused by Omicron due to absenteeism, reduction of operations, or temporary closure of enterprises may lead to wage growth remaining moderate this month. If this happens, at the end of January, we will see a new surge in applications for unemployment benefits, which will offset the gains from the effect of the weakening of the coronavirus.

The report on secondary applications showed that the number of people receiving benefits after the first week of assistance increased from 84,000 to 1.635 million in the week ending January 8. These so-called continuing applications remained below 2 million for the eighth week in a row. However, the growth of extended benefits is impressive.

These figures suggest that the reports are lying: there are much fewer jobs that are competitive and ready to accept people today, otherwise, we would have seen an impressive increase in production and sales, which contradicts the data. My opinion remains the same: the government is wishful thinking to quickly introduce an upward regime of interest rates, putting a barrier to rampant inflation.

In the meantime, the latest reports on applications will hit the indices, although they are still growing. The yield of 10-year benchmark bonds is also rising, and the spot dollar rose by 0.03%. The euro/dollar pair is falling, the indices are also likely to turn around during the American session.

-

24-01-2022, 07:35 AM #2870

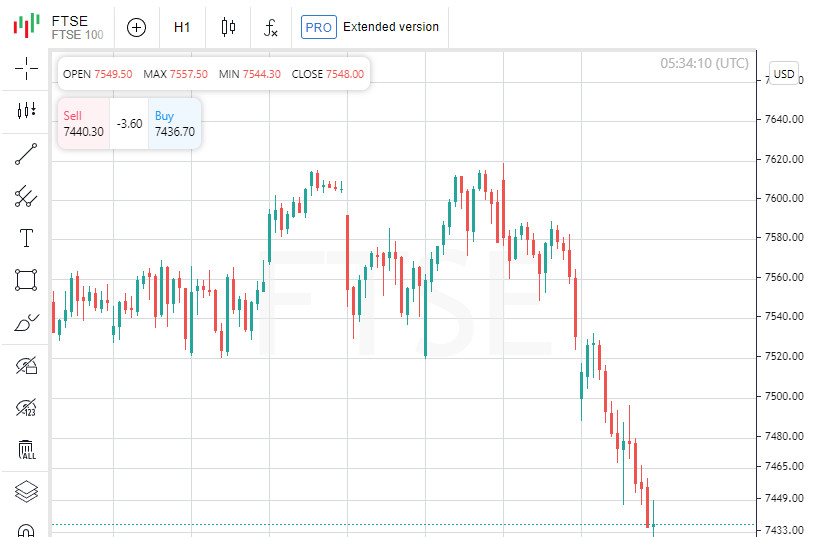

European stock markets ended trading on Friday in the red

Stock indices of the countries of the Asia-Pacific region closed in the red on Friday, a similar trend has developed in the US stock market. Analysts attribute the fall in world markets to the prospects for a more aggressive than expected increase in rates by the Federal Reserve System.

Meanwhile, retail sales in the UK fell 3.7% in December from the previous month, showing the biggest drop since January, according to data from the National Statistics Office (ONS). Analysts on average had forecast a decline of just 0.6%. In annual terms, sales decreased by 0.9% instead of the expected growth of 3.4%.

Despite the decline in December, retail sales this month were up 2.6% compared to pre-pandemic February 2020. For 2021 as a whole, sales jumped 5.1%, the fastest pace since 2004.

The composite index of the largest enterprises in the Stoxx Europe 600 region fell by 1.8% to 474.44 points as a result of trading. At the same time, all sectoral sub-indices declined, the financial and technology sectors the most.

Losses of the indicator for the entire past week amounted to 1.5% on fears of tightening the monetary policy of the world's central banks and increased tensions between Russia and the United States.

The German DAX index fell by 1.9% during the day, the French CAC 40 - by 1.75%, the British FTSE 100 - by 1.2%. Spain's IBEX 35 shed 1.4% and Italy's FTSE MIB shed 1.9%.

German Siemens Energy AG shares plunged 16.6% on Friday after Siemens Gamesa subsidiary Renewable Energy SA released preliminary financial results for the first quarter.

The price of Siemens Gamesa fell 14%. The company posted an adjusted EBIT loss of €309m against a profit of €121m in the same period a year earlier, while its revenue fell to €1.8bn from €2.3bn. Siemens Gamesa also downgraded its forecasts for the main financial indicators for the 2022 financial year.

The fall leader in the Stoxx Europe 600 index, in addition to Siemens and Siemens Gamesa, was the Danish wind turbine manufacturer Vestas Wind Systems A/S (-9%). Also, steel ThyssenKrupp AG (-7.2%) and e-commerce platform InPost S.A. (-8.6%).

The energy sector went into the red zone following the fall in oil prices, including the value of Royal Dutch Shell Plc decreased by 1.7% and BP Plc - by 1.8%.

TotalEnergies on Friday announced its decision to pull out of a natural gas project in Myanmar and stop doing business in the country, which suffered a military coup in February 2021. The company will not receive financial compensation, its share in the Yadana field and the MGTC gas pipeline will be distributed among project partners. Capitalization of TotalEnergies for the day fell by 2.1%.

In addition, securities of the semiconductor industry, including ASML Holding (-1.7%) and AMS (-3.6%), as well as software developer SAP (-1.2%), fell in price.

Meanwhile, the shares of the German developer of software for remote connection TeamViewer AG (+4.3%) and the Polish retailer Dino Polska (+3.6%) grew most significantly

News are provided by

InstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 12 users browsing this thread. (0 members and 12 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote