EUR/USD: the euro suffers from uncertainty about the Fed's future steps, and the dollar wonders when the central bank will present it with a gift in the form of an interest rate hike

Less than two weeks ago, the words of Federal Reserve Chairman Jerome Powell that the central bank's plans to raise interest rates would not lead to a slowdown in the growth of the national economy, allowed market participants to consider the issue of tightening monetary policy in the United States resolved.

Fears that the Fed could throw the stock market under the bus to eradicate high inflation led to the strongest weekly drop in the S&P 500 index since the beginning of the pandemic in March 2020 (by 5.7%).

The shares suffered due to investors' concern for the fate of the corporate sector, which will lose cheap money during the deterioration of macro statistics in the country.

Thus, retail sales in the United States in December decreased by 1.9% compared to the previous month, although experts did not expect a change in the indicator.

Last month, the volume of industrial production in the country decreased by 0.1% with an expected growth of 0.3%.

The consumer confidence index from the University of Michigan in January sank to 68.8 points from 70.6 points recorded in December, which was the second lowest level in a decade.

The number of initial applications of Americans for unemployment benefits for the week ending January 15 increased by 55,000, reaching 286,000, which is the highest since mid-October.

News are provided by

InstaForex.

Please visit our sponsors

Results 2,871 to 2,880 of 3458

Thread: Forex News from InstaForex

-

25-01-2022, 10:15 AM #2871

-

26-01-2022, 10:03 AM #2872

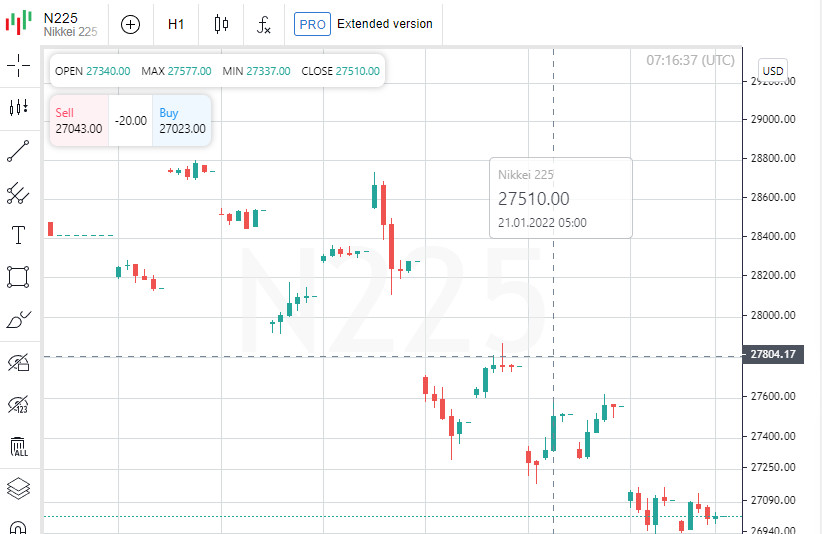

Most Asian stock markets are trading in the red

The Federal Reserve may signal to markets that it is ready to start raising interest rates in March following its January meeting, which ends on Wednesday, analysts say. This will be the first rate hike since 2018.

The easing of monetary policy was caused by the COVID-19 pandemic. But now the Fed may also say that it is considering other options for tightening monetary policy to combat rising inflation, CNBC notes.

A growing number of Fed officials and Wall Street economists see the possibility of more than three hikes in the base interest rate by the US Central Bank this year against the backdrop of a significant rise in consumer prices. They explain these forecasts as signals that inflation in the US, which is at a maximum for almost 40 years, affects all segments of the economy, while the labor market is growing rapidly.

The Japanese Nikkei fell by 0.4% by 8:36 GMT+2.

Among the components of the index, the shares of Idemitsu Kosan Co. are the leaders of decline. Ltd. (-8.8%), Shionogi & Co. Ltd. (-5.9%) and Ricoh Co. Ltd. (-4.9%).

Shares of the metallurgical company Japan Steel Works Ltd. lose 2.5%, shares of IT company Rakuten Group Inc. grow by 0.7%, investment SoftBank Group Corp. add 1.8%.

The Hong Kong Hang Seng fell by 0.1% by 8:45 GMT+2, while the Shanghai Shanghai Composite rose by 0.3%.

Shenzhou International Group Holdings Ltd (-7.4%), Wuxi Biologics (Cayman) Inc. are the decline leaders in Hang Seng. (-6.5%) and Li Ning Co. Ltd.(-3.08%).

Shares of automaker Geely Automobile Holdings Ltd. are cheaper by 2.3%, technology company JD.com Inc. - grow by 1.4%.

South Korean Kospi lost 0.15% by 8:45 GMT+2.

Shares of automaker Kia Corp. (KS:000270) up 1.8%, shares of Hyundai Motor Co. decrease by 2.1%.

The cost of chip and electronics manufacturer Samsung Electronics Co. is down 0.8%, its rival LG Corp. grows by 0.1%.

Australian stock exchanges are closed due to the holiday (Australia Day).

News are provided by

InstaForex.

-

27-01-2022, 09:09 AM #2873

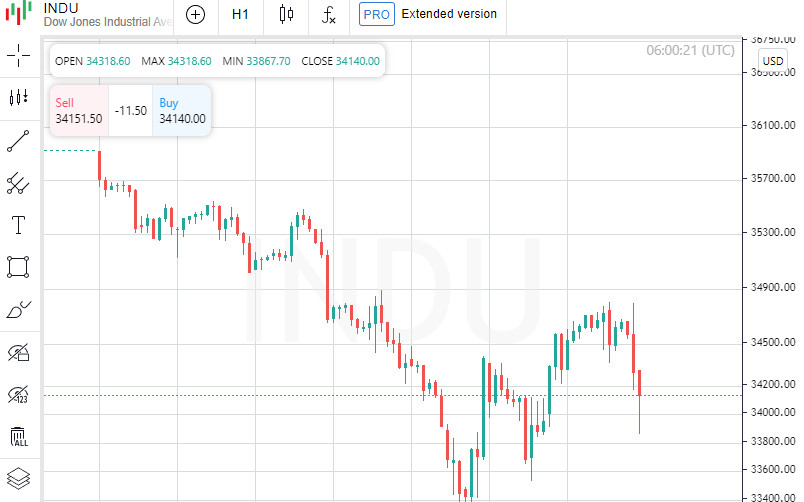

US stock indices ended trading without a single dynamics

The Dow Jones Industrial Average fell 129.64 points (0.38%) by the close of trading to 34,168.09 points.

The Standard & Poor's 500 lost 6.52 points (0.15%) to 4349.93 points.

The Nasdaq Composite increased 2.82 points (0.02%) to 13542.12.

The Fed kept the interest rate on federal funds (federal funds rate) in the range from 0% to 0.25% per annum. The decision coincided with the forecasts of economists and market participants.

The Federal Open Market Committee (FOMC) of the Fed aims to achieve maximum employment and inflation at 2% in the long term. To support this goal, the committee decided to maintain the target range for the federal funds rate at 0-0.25%.

At the same time, since inflation is well above 2% per annum with a strong labor market situation, committee members expect that it will soon be appropriate to raise the target rate range. At the same time, the head of the Fed, Jerome Powell, during a press conference following the meeting, noted that FOMC members intend to raise interest rates already at the March meeting.

The American Central Bank also announced that it plans to continue reducing the volume of the asset buyback program and intends to curtail it in March.

Meanwhile, traders followed the ongoing reporting season of US companies.

Boeing Co. shares lost 4.8% in price on the news that the company's revenue fell by 3.3% and turned out to be worse than the market forecast, which was waiting for its growth.

Exchange operator Nasdaq Inc. in October-December increased profit by 16%, revenue - by 12%, and the latter figure and adjusted profit were higher than experts' expectations. Nasdaq shares fell 3.1%.

Telecommunications and media company AT&T Inc. returned to profitability last quarter, with adjusted earnings and revenue above forecasts. Capitalization of AT&T, however, decreased by 8.4%.

Freeport-McMoRan Inc. share price fell by 3%, although the producer of copper and gold in the last quarter of 2021 increased its net profit by 57%, revenue by 37%.

Automatic Data Processing lost 9% despite the HR software and services provider posting better-than-expected earnings and revenue in the second quarter of fiscal 2022.

Consumer goods manufacturer Kimberly-Clark Corp. in October-December of the year reduced net profit by a third, despite the growth in revenue, due to increased costs. The value of the company fell by 3.4%.

Meanwhile, US new home sales jumped 11.9% in December from the previous month to 811,000 annualized, the country's Commerce Department said. According to the revised data, 725,000 houses were sold in November (an increase of 11.7% MoM), while previously the figure was 744,000 (a jump of 12.4%).

Analysts, on average, expected a 1.8% increase in new home sales last month from the previously announced November level to 757,000.

Stock quotes of large American construction companies Lennar Corp. and KB Home were down 4.5% and 4.8%, respectively.

News are provided by

InstaForex.

-

28-01-2022, 09:13 AM #2874

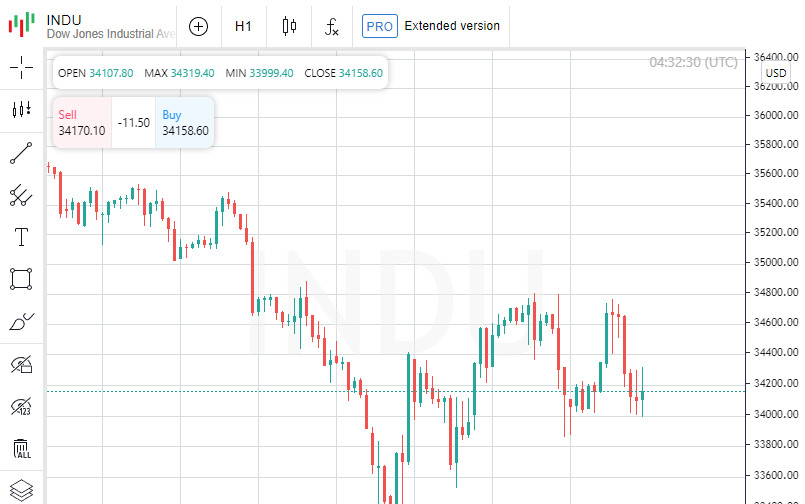

US stocks closed lower, Dow Jones down 0.02%

At the close on the New York Stock Exchange, the Dow Jones fell 0.02% to a one-month low, the S&P 500 index fell 0.54%, and the NASDAQ Composite index fell 1.40%. Dow Inc was the top performer among the components of the

Dow Jones index today, up 2.96 points or 5.17% to close at 60.18. Chevron Corp rose 2.68 points or 2.02% to close at 135.37. Merck & Company Inc rose 1.44 points or 1.82% to close at 80.58.

The losers were shares of Intel Corporation, which lost 3.64 points or 7.04% to end the session at 48.05. Boeing Co was up 2.33% or 4.52 points to close at 189.75 while American Express Company was down 1.95% or 3.42 points to close at 171. 90.

Among the S&P 500 index components gainers today were ServiceNow Inc, which rose 9.14% to hit 528.69, Ball Corporation, which gained 8.57% to close at 93.99, and Seagate Technology PLC, which gained 7.65% to end the session at 103.68.

The biggest losers were Teradyne Inc, which shed 22.41% to close at 111.24. Shares of Tesla Inc lost 11.55% and ended the session at 829.10. Quotes of Advanced Micro Devices Inc decreased in price by 7.33% to 102.60.

The leading gainers among the components of the NASDAQ Composite in today's trading were National Security Group Inc, which rose 69.65% to 15.65, Sidus Space Inc, which gained 31.55% to close at 10.80. as well as shares of Galapagos NV ADR, which rose 22.47% to close the session at 65.30.

The biggest losers were Epizyme Inc, which shed 44.21% to close at 1.060. Shares of TG Therapeutics Inc shed 40.65% to end the session at 8.25. Quotes of Cyngn Inc decreased in price by 36.47% to 1.62.

On the New York Stock Exchange, the number of securities that fell in price (2349) exceeded the number of those that closed in positive territory (941), while quotes of 143 shares remained virtually unchanged. On the NASDAQ stock exchange, 3,122 companies fell in price, 838 rose, and 174 remained at the level of the previous close.

Chevron Corp shares rose to an all-time high, up 2.02%, 2.68 points, to close at 135.37. Shares in National Security Group Inc surged to a 52-week high, up 69.65% or 6.43 points to close at 15.65. Epizyme Inc shares fell to all-time lows, down 44.21% or 0.840 to close at 1.060. TG Therapeutics Inc shares fell to a 52-week low, falling 40.65%, 5.65 points, to close at 8.25. Cyngn Inc shares tumbled to all-time lows, dropping 36.47% or 0.93 points to close at 1.62.

The CBOE Volatility Index, which is based on S&P 500 options trading, fell 4.60% to 30.49.

Gold futures for February delivery lost 1.81%, or 33.15, to $1,796.55 a troy ounce. In other commodities, WTI crude for March delivery fell 0.08%, or 0.07, to $87.28 a barrel. Brent oil futures for April delivery rose 0.24%, or 0.21, to $88.90 a barrel.

Meanwhile, in the Forex market, EUR/USD fell 0.02% to hit 1.1141, while USD/JPY shed 0.01% to hit 115.32.

Futures on the USD index rose 0.87% to 97.235.

News are provided by

InstaForex.

-

31-01-2022, 05:20 PM #2875

Dollar is still full of determination and strength, and the turning point for EUR/USD has not yet arrived

During the pandemic, the US stock market, represented by the S&P 500 index, increased by about 120% from the low of March 2020 to the high of January 2022. During this period, stock investors even developed a reflex of buying on drawdowns, since fears of the consequences of the pandemic were offset by the fact that the US central bank and the federal government were lending a shoulder to the national economy, and through it to the markets.

"What cheap money has done is provide protection from bad news. But as this comfortable blanket is lifted, investors will be more vulnerable, and we suspect that this will create a more unstable environment for asset prices," Rabobank strategists noted.

Market participants were optimistic about entering 2022, believing that a strong US economy and further growth in corporate profits would keep stocks on an upward trajectory, even despite tightening monetary conditions in the United States.

Thanks to these expectations, on January 4, the S&P 500 index updated its record peaks at the level of 4818 points.

, the next three weeks showed that there are more reasons for anxiety than for optimism. This resulted in the S&P 500 falling from record highs by more than 10%.

The wave of sales began with fears that the Federal Reserve, which decided to tame inflation, would become very aggressive.

The first alarm bell sounded on January 5, when the minutes from the December FOMC meeting were published, which showed investors that interest rates in the United States would soon rise.

Then, on January 11, speaking in Congress, Fed Chairman Jerome Powell stressed that the American economy no longer needs an accommodative policy and that the fight against inflation is a top priority for the central bank.

Member of the Board of Governors of the Federal Reserve Leil Brainard supported her boss, noting that inflation in the United States is too high and called its containment the most important task of the central bank. She also said that it would be right to start raising rates as soon as the bond purchase program is completed.

A number of Fed officials also spoke in favor of starting to raise rates in March, and St. Louis Fed President James Bullard said that four interest rate hikes may be required this year amid high inflation.

On the eve of the January FOMC meeting, investors still had a glimmer of hope that Powell will take into account the fall in stocks and soften his tone.

However, leaving the possibility for a larger and faster-than-expected increase in interest rates, Powell showed that the fall in stocks in itself causes less concern to the Fed leadership.

At a press conference, Powell acknowledged that inflation may remain high for longer than expected and that a rate hike at every FOMC meeting this year is not out of the question.

Against this background, US stocks quickly lost all gains for the day and closed in negative territory on Wednesday: the S&P 500 lost 0.15%.

The index also ended yesterday's trading with a decrease (by 0.54%) after the initial growth.

On Thursday, traders continued to evaluate the results of the January Fed meeting.

The range between the highest and lowest values of the indicators reached the day before was not as significant as in previous sessions this week, but continued to indicate the persistence of volatile market sentiment.

Initially, investors reacted positively to the report, which reflected the growth of American GDP at the highest pace in almost 40 years in the fourth quarter. However, subsequently, the S&P 500 index was again under pressure, including the realization that the impressive economic growth in the United States was caused by low interest rates, pent-up demand and a huge fiscal stimulus package of $1.9 trillion.

by some signs, the growth rate of national GDP is already slowing down. According to the latest survey of purchasing managers, activity in the US service sector has fallen to an 18-month low. Retail sales in the country declined sharply in December. Consumer confidence is also at a low level. Although some events can be explained by the recent outbreak of Omicron, this may also indicate a decline in underlying demand.

In addition, there are fears that the easy money that supports stocks will be gradually withdrawn, and corporate profits will decrease on both sides – due to a slowdown in income growth amid a downturn in the economy, as well as due to an increase in wage costs.

The US stock market ends the current week on a minor note, and experts disagree about its future prospects.

While some analysts believe that the sell-off is nearing its final stage, others predict an even bigger drop in stocks.

Goldman Sachs analysts believe that it's time to buy, as after the decline in the prices of many stocks have reached attractive levels.

[img]https://forex-images.ifxdb.com/userfiles/20220128/analytics61f439aa3e61b_source!.jpg[/img]

"Any further significant weakness in the S&P 500 index should be considered as a buying opportunity, from our point of view, although with moderate growth potential during the year as a whole," the bank's specialists said.

"The Fed will raise interest rates in 2022 to tame rising inflation, which is close to a 40-year high, but the central bank is likely to raise rates to a relatively low level," they added.

According to the forecast of Goldman Sachs, the S&P 500 index will grow to 5,000 points by the middle of the year, and by the end of the year it will rise to 5,100 points.

The sell-off on the US stock market is at the last stage, as investors' concerns about the federal funds rate hike and weak company profits are exaggerated, analysts at JPMorgan believe.

"If the stock market sell-off continues, the Fed could potentially change its policy to stop the fall. Easing expectations on the pace of interest rate hikes this year or delaying plans to reduce the Fed's balance sheet will help return investors' interest in risky assets," they said.

Following the results of the FOMC meeting and the press conference, Powell's futures market quickly put into quotes expectations of another, fifth, increase in the federal funds rate this year. This event triggered the decline of the S&P 500.

, due to fears of a real collapse of the US stock market, the Fed will raise rates only three times this year, economists at Mizuho Bank believe.

Meanwhile, Morgan Stanley strategists claim that the correction in the US stock market is not over yet.

They predict that the S&P 500 index could fall another 10% from current levels and drop below 4,000 points over the next three to four weeks.

"Apparently, investors underestimate the consequences of tightening monetary policy in the United States, as well as the potential slowdown in economic growth in the country. Therefore, we recommend doubling the share of investments in protective assets before the upcoming correction in the market," the bank noted.

flight from risky assets, provoked by the results of the January Fed meeting, led not only to the fall of the S&P 500, but to the rally of the US dollar against all major competitors.

Over the past week, the greenback has added about 1.8% to the euro, almost 2% to the antipodes, and the USD index has risen above 97 for the first time since July 2020.

"Powell made it clear that the increase in interest rates and the reduction of the balance sheet may occur faster than during the previous tightening cycle. We expect further growth of the dollar against the background of normalization of monetary policy in the United States, and the January FOMC meeting should give it an additional impetus," HSBC analysts said.

The US currency may well move to the next target in the 97.70–98.00 zone, beyond which there are practically no technical resistances up to the 100.00 mark, according to OCBC Bank.

It should be noted that the greenback did not start the current year well and initially defied the overwhelming consensus that it should strengthen, but then it was able to get up from its knees and is now close to showing the best week in the last seven months.

On Friday, the USD index updated 19-month highs in the area of 97.40-97.45, after which the bullish momentum weakened somewhat, but remains, which means that the markets continue to put more aggressive Fed rate hikes in quotes.

Some experts believe that after the "dust" settles down regarding the prospects for rates, the dollar rally will begin to run out of steam.

"The greenback is at cyclical highs, and it needs to move on, as the differential of interest rates and the increased level of market volatility provide support for the US currency. However, this is most likely the last stage of the USD movement," Societe Generale strategists said.

"There is a possibility that the global economy will come out of the worst period of the COVID-19 pandemic this year, and the market focus will shift to the normalization of monetary policy and growth outside the United States. In such a scenario, the best yield of the currency in the second half of this year will be obtained outside the world's largest economy," they added.

Wednesday, Powell not only left the door open to raising rates faster than in previous cycles, but also warned that the balance sheet reduction would be significant.

However, the question arises: how much will inflation fall in response to the first rounds of policy tightening. And will that be enough?

If price pressure is able to ease quickly, the Fed's mood may turn out to be less hawkish, which will allow stocks to breathe a sigh of relief, and the greenback will be under pressure.

However, if aggressive efforts of the US central bank are required to reverse the price trend, the tone of its statements will be "belligerent", which may frighten the market and will increase expectations of further rate hikes, which in turn will support the dollar.

At the same time, it is difficult to predict the consequences that such sharp increases in interest rates and such powerful asset sales from the Fed's balance sheet will lead to.

A popular harbinger of a recession in the United States - the spread between 10- and 2-year government bonds - has fallen to a low since November 2020 mainly due to the fact that short-term yields jumped, and long-term yields barely moved places, hinting that some traders consider the position of the US central bank slightly reckless and begin to put the hawkish error of the Fed in quotes.

If a serious collapse in the US stock market begins, which will increase the risks of a sharp slowdown in economic growth in the country, the central bank will have no choice but to soften the rhetoric at some point.

There are some more good news that investors can cling to. Omicron may be the last wave of the pandemic. As it weakens, the problems in the labor market related to inflation may disappear.

All th

"If market expectations regarding central banks continue to grow in general, the ECB's capitulation in the context of the need to raise rates may be a turning point that will support the euro, however, this moment has not yet come. If longer-term yields in the US remain anchored, we will not necessarily see a rapid drop down. But in the future, either tightening by the Fed will bring down the markets, or the same shift in ECB policy will come," they added.

On Friday, the EUR/USD pair updated a 20-month low around 1.1125 before recovering to 1.1170. \

Divergence in the rates of the ECB and the Fed is likely to limit the growth of EUR/USD and allow the pair to continue to decline, at least until the key ECB meeting in March, Westpac analysts say.

"The chart of the yield spreads of two-year US and European government bonds clearly reflects the direction of this divergence. It should persist unless the ECB announces the end of PEPP and revises policy and economic forecasts in March. The inability of the EUR/USD pair to settle above 1.1400 in January may cause testing of 1.1000-1.1050," they believe.

The jump in short-term rates in the US due to the hawkish position of the Fed has led the EUR/USD pair to new cycle lows, and it seems that the test of the 1.1000 level is only a matter of time, ING economists note.

On the eve of the ECB meeting, which will be held next Thursday, the consumer price index in the eurozone for January will be released. The indicator is expected to reach 4.3% year-on-year, as some of the underlying effects will disappear. More clear signs that inflation peaked at 5% in December are unlikely to force the ECB to take a more aggressive stance. Since the European Central Bank does not support short-term interest rates in the eurozone, the EUR/USD pair will remain at the mercy of the Fed's policy tightening cycle," they said.

"The downward momentum in the euro was reinforced by the hawkish update of the Fed's policy. The head of the US central bank, J. Powell has opened the door for faster rate hikes than during the previous tightening cycle. Recent events confirm our forecast of a decline in the EUR/USD pair to 1,1000 in the first quarter. The downward pressure on the pair may increase in the near future if tensions between Russia and Ukraine increase. However, in the coming week, the bearish trend in the euro will be challenged if the ECB does not provide such strong resistance to expectations of an interest rate increase this year," MUFG Bank said.

The main currency pair has not yet managed to launch a convincing recovery, and it looks vulnerable due to the continuing divergence in the rates of the ECB and the Fed, which continues to support the outflow of capital from the eurozone. In this regard, attempts to increase EUR/USD can still be regarded as a convenient opportunity for short positions.

The initial resistance is at 1.1185. Its breakout may trigger a short squeeze, although growth may be stopped near the 1.1230 mark, which will be a key turning point for short-term traders. Its clean breakdown will lay the foundation for further recovery of the pair.

The nearest support is located around 1.1100, the breakdown of which will allow the bears to aim for 1.1050 and 1.1000.

is will have a negative impact on the defensive greenback, but for now it is determined and strong enough to challenge his main competitors.

The rally of the US currency has already led to the fact that the EUR/USD pair has sunk to the levels it last visited in June 2020.

"The main currency pair collapsed as the market was forced to assess the risk that the Fed could implement a larger rate hike this year than initially expected. This happened after the announcement of the results of the January FOMC meeting and the press conference of Powell. Meanwhile, signals from key members of the ECB board of directors continue to indicate that the central bank intends to adjust monetary policy gradually, believing that inflation will be transient," analysts at Saxo Bank noted.

Dollar is still full of determination and strength, and the turning point for EUR/USD has not yet arrived

During the pandemic, the US stock market, represented by the S&P 500 index, increased by about 120% from the low of March 2020 to the high of January 2022. During this period, stock investors even developed a reflex of buying on drawdowns, since fears of the consequences of the pandemic were offset by the fact that the US central bank and the federal government were lending a shoulder to the national economy, and through it to the markets.

"What cheap money has done is provide protection from bad news. But as this comfortable blanket is lifted, investors will be more vulnerable, and we suspect that this will create a more unstable environment for asset prices," Rabobank strategists noted.

Market participants were optimistic about entering 2022, believing that a strong US economy and further growth in corporate profits would keep stocks on an upward trajectory, even despite tightening monetary conditions in the United States.

Thanks to these expectations, on January 4, the S&P 500 index updated its record peaks at the level of 4818 points.

, the next three weeks showed that there are more reasons for anxiety than for optimism. This resulted in the S&P 500 falling from record highs by more than 10%.

The wave of sales began with fears that the Federal Reserve, which decided to tame inflation, would become very aggressive.

The first alarm bell sounded on January 5, when the minutes from the December FOMC meeting were published, which showed investors that interest rates in the United States would soon rise.

Then, on January 11, speaking in Congress, Fed Chairman Jerome Powell stressed that the American economy no longer needs an accommodative policy and that the fight against inflation is a top priority for the central bank.

Member of the Board of Governors of the Federal Reserve Leil Brainard supported her boss, noting that inflation in the United States is too high and called its containment the most important task of the central bank. She also said that it would be right to start raising rates as soon as the bond purchase program is completed.

A number of Fed officials also spoke in favor of starting to raise rates in March, and St. Louis Fed President James Bullard said that four interest rate hikes may be required this year amid high inflation.

On the eve of the January FOMC meeting, investors still had a glimmer of hope that Powell will take into account the fall in stocks and soften his tone.

However, leaving the possibility for a larger and faster-than-expected increase in interest rates, Powell showed that the fall in stocks in itself causes less concern to the Fed leadership.

At a press conference, Powell acknowledged that inflation may remain high for longer than expected and that a rate hike at every FOMC meeting this year is not out of the question.

Against this background, US stocks quickly lost all gains for the day and closed in negative territory on Wednesday: the S&P 500 lost 0.15%.

The index also ended yesterday's trading with a decrease (by 0.54%) after the initial growth.

On Thursday, traders continued to evaluate the results of the January Fed meeting.

The range between the highest and lowest values of the indicators reached the day before was not as significant as in previous sessions this week, but continued to indicate the persistence of volatile market sentiment.

Initially, investors reacted positively to the report, which reflected the growth of American GDP at the highest pace in almost 40 years in the fourth quarter. However, subsequently, the S&P 500 index was again under pressure, including the realization that the impressive economic growth in the United States was caused by low interest rates, pent-up demand and a huge fiscal stimulus package of $1.9 trillion.

by some signs, the growth rate of national GDP is already slowing down. According to the latest survey of purchasing managers, activity in the US service sector has fallen to an 18-month low. Retail sales in the country declined sharply in December. Consumer confidence is also at a low level. Although some events can be explained by the recent outbreak of Omicron, this may also indicate a decline in underlying demand.

In addition, there are fears that the easy money that supports stocks will be gradually withdrawn, and corporate profits will decrease on both sides – due to a slowdown in income growth amid a downturn in the economy, as well as due to an increase in wage costs.

The US stock market ends the current week on a minor note, and experts disagree about its future prospects.

While some analysts believe that the sell-off is nearing its final stage, others predict an even bigger drop in stocks.

Goldman Sachs analysts believe that it's time to buy, as after the decline in the prices of many stocks have reached attractive levels.

[img]https://forex-images.ifxdb.com/userfiles/20220128/analytics61f439aa3e61b_source!.jpg[/img]

"Any further significant weakness in the S&P 500 index should be considered as a buying opportunity, from our point of view, although with moderate growth potential during the year as a whole," the bank's specialists said.

"The Fed will raise interest rates in 2022 to tame rising inflation, which is close to a 40-year high, but the central bank is likely to raise rates to a relatively low level," they added.

According to the forecast of Goldman Sachs, the S&P 500 index will grow to 5,000 points by the middle of the year, and by the end of the year it will rise to 5,100 points.

The sell-off on the US stock market is at the last stage, as investors' concerns about the federal funds rate hike and weak company profits are exaggerated, analysts at JPMorgan believe.

"If the stock market sell-off continues, the Fed could potentially change its policy to stop the fall. Easing expectations on the pace of interest rate hikes this year or delaying plans to reduce the Fed's balance sheet will help return investors' interest in risky assets," they said.

Following the results of the FOMC meeting and the press conference, Powell's futures market quickly put into quotes expectations of another, fifth, increase in the federal funds rate this year. This event triggered the decline of the S&P 500.

, due to fears of a real collapse of the US stock market, the Fed will raise rates only three times this year, economists at Mizuho Bank believe.

Meanwhile, Morgan Stanley strategists claim that the correction in the US stock market is not over yet.

They predict that the S&P 500 index could fall another 10% from current levels and drop below 4,000 points over the next three to four weeks.

"Apparently, investors underestimate the consequences of tightening monetary policy in the United States, as well as the potential slowdown in economic growth in the country. Therefore, we recommend doubling the share of investments in protective assets before the upcoming correction in the market," the bank noted.

flight from risky assets, provoked by the results of the January Fed meeting, led not only to the fall of the S&P 500, but to the rally of the US dollar against all major competitors.

Over the past week, the greenback has added about 1.8% to the euro, almost 2% to the antipodes, and the USD index has risen above 97 for the first time since July 2020.

"Powell made it clear that the increase in interest rates and the reduction of the balance sheet may occur faster than during the previous tightening cycle. We expect further growth of the dollar against the background of normalization of monetary policy in the United States, and the January FOMC meeting should give it an additional impetus," HSBC analysts said.

The US currency may well move to the next target in the 97.70–98.00 zone, beyond which there are practically no technical resistances up to the 100.00 mark, according to OCBC Bank.

It should be noted that the greenback did not start the current year well and initially defied the overwhelming consensus that it should strengthen, but then it was able to get up from its knees and is now close to showing the best week in the last seven months.

On Friday, the USD index updated 19-month highs in the area of 97.40-97.45, after which the bullish momentum weakened somewhat, but remains, which means that the markets continue to put more aggressive Fed rate hikes in quotes.

Some experts believe that after the "dust" settles down regarding the prospects for rates, the dollar rally will begin to run out of steam.

"The greenback is at cyclical highs, and it needs to move on, as the differential of interest rates and the increased level of market volatility provide support for the US currency. However, this is most likely the last stage of the USD movement," Societe Generale strategists said.

"There is a possibility that the global economy will come out of the worst period of the COVID-19 pandemic this year, and the market focus will shift to the normalization of monetary policy and growth outside the United States. In such a scenario, the best yield of the currency in the second half of this year will be obtained outside the world's largest economy," they added.

Wednesday, Powell not only left the door open to raising rates faster than in previous cycles, but also warned that the balance sheet reduction would be significant.

However, the question arises: how much will inflation fall in response to the first rounds of policy tightening. And will that be enough?

If price pressure is able to ease quickly, the Fed's mood may turn out to be less hawkish, which will allow stocks to breathe a sigh of relief, and the greenback will be under pressure.

However, if aggressive efforts of the US central bank are required to reverse the price trend, the tone of its statements will be "belligerent", which may frighten the market and will increase expectations of further rate hikes, which in turn will support the dollar.

At the same time, it is difficult to predict the consequences that such sharp increases in interest rates and such powerful asset sales from the Fed's balance sheet will lead to.

A popular harbinger of a recession in the United States - the spread between 10- and 2-year government bonds - has fallen to a low since November 2020 mainly due to the fact that short-term yields jumped, and long-term yields barely moved places, hinting that some traders consider the position of the US central bank slightly reckless and begin to put the hawkish error of the Fed in quotes.

If a serious collapse in the US stock market begins, which will increase the risks of a sharp slowdown in economic growth in the country, the central bank will have no choice but to soften the rhetoric at some point.

There are some more good news that investors can cling to. Omicron may be the last wave of the pandemic. As it weakens, the problems in the labor market related to inflation may disappear.

All th

"If market expectations regarding central banks continue to grow in general, the ECB's capitulation in the context of the need to raise rates may be a turning point that will support the euro, however, this moment has not yet come. If longer-term yields in the US remain anchored, we will not necessarily see a rapid drop down. But in the future, either tightening by the Fed will bring down the markets, or the same shift in ECB policy will come," they added.

On Friday, the EUR/USD pair updated a 20-month low around 1.1125 before recovering to 1.1170. \

Divergence in the rates of the ECB and the Fed is likely to limit the growth of EUR/USD and allow the pair to continue to decline, at least until the key ECB meeting in March, Westpac analysts say.

"The chart of the yield spreads of two-year US and European government bonds clearly reflects the direction of this divergence. It should persist unless the ECB announces the end of PEPP and revises policy and economic forecasts in March. The inability of the EUR/USD pair to settle above 1.1400 in January may cause testing of 1.1000-1.1050," they believe.

The jump in short-term rates in the US due to the hawkish position of the Fed has led the EUR/USD pair to new cycle lows, and it seems that the test of the 1.1000 level is only a matter of time, ING economists note.

On the eve of the ECB meeting, which will be held next Thursday, the consumer price index in the eurozone for January will be released. The indicator is expected to reach 4.3% year-on-year, as some of the underlying effects will disappear. More clear signs that inflation peaked at 5% in December are unlikely to force the ECB to take a more aggressive stance. Since the European Central Bank does not support short-term interest rates in the eurozone, the EUR/USD pair will remain at the mercy of the Fed's policy tightening cycle," they said.

"The downward momentum in the euro was reinforced by the hawkish update of the Fed's policy. The head of the US central bank, J. Powell has opened the door for faster rate hikes than during the previous tightening cycle. Recent events confirm our forecast of a decline in the EUR/USD pair to 1,1000 in the first quarter. The downward pressure on the pair may increase in the near future if tensions between Russia and Ukraine increase. However, in the coming week, the bearish trend in the euro will be challenged if the ECB does not provide such strong resistance to expectations of an interest rate increase this year," MUFG Bank said.

The main currency pair has not yet managed to launch a convincing recovery, and it looks vulnerable due to the continuing divergence in the rates of the ECB and the Fed, which continues to support the outflow of capital from the eurozone. In this regard, attempts to increase EUR/USD can still be regarded as a convenient opportunity for short positions.

The initial resistance is at 1.1185. Its breakout may trigger a short squeeze, although growth may be stopped near the 1.1230 mark, which will be a key turning point for short-term traders. Its clean breakdown will lay the foundation for further recovery of the pair.

The nearest support is located around 1.1100, the breakdown of which will allow the bears to aim for 1.1050 and 1.1000.

is will have a negative impact on the defensive greenback, but for now it is determined and strong enough to challenge his main competitors.

The rally of the US currency has already led to the fact that the EUR/USD pair has sunk to the levels it last visited in June 2020.

"The main currency pair collapsed as the market was forced to assess the risk that the Fed could implement a larger rate hike this year than initially expected. This happened after the announcement of the results of the January FOMC meeting and the press conference of Powell. Meanwhile, signals from key members of the ECB board of directors continue to indicate that the central bank intends to adjust monetary policy gradually, believing that inflation will be transient," analysts at Saxo Bank noted.

Dollar is still full of determination and strength, and the turning point for EUR/USD has not yet arrived

During the pandemic, the US stock market, represented by the S&P 500 index, increased by about 120% from the low of March 2020 to the high of January 2022. During this period, stock investors even developed a reflex of buying on drawdowns, since fears of the consequences of the pandemic were offset by the fact that the US central bank and the federal government were lending a shoulder to the national economy, and through it to the markets.

"What cheap money has done is provide protection from bad news. But as this comfortable blanket is lifted, investors will be more vulnerable, and we suspect that this will create a more unstable environment for asset prices," Rabobank strategists noted.

Market participants were optimistic about entering 2022, believing that a strong US economy and further growth in corporate profits would keep stocks on an upward trajectory, even despite tightening monetary conditions in the United States.

Thanks to these expectations, on January 4, the S&P 500 index updated its record peaks at the level of 4818 points.

, the next three weeks showed that there are more reasons for anxiety than for optimism. This resulted in the S&P 500 falling from record highs by more than 10%.

The wave of sales began with fears that the Federal Reserve, which decided to tame inflation, would become very aggressive.

The first alarm bell sounded on January 5, when the minutes from the December FOMC meeting were published, which showed investors that interest rates in the United States would soon rise.

Then, on January 11, speaking in Congress, Fed Chairman Jerome Powell stressed that the American economy no longer needs an accommodative policy and that the fight against inflation is a top priority for the central bank.

Member of the Board of Governors of the Federal Reserve Leil Brainard supported her boss, noting that inflation in the United States is too high and called its containment the most important task of the central bank. She also said that it would be right to start raising rates as soon as the bond purchase program is completed.

A number of Fed officials also spoke in favor of starting to raise rates in March, and St. Louis Fed President James Bullard said that four interest rate hikes may be required this year amid high inflation.

On the eve of the January FOMC meeting, investors still had a glimmer of hope that Powell will take into account the fall in stocks and soften his tone.

However, leaving the possibility for a larger and faster-than-expected increase in interest rates, Powell showed that the fall in stocks in itself causes less concern to the Fed leadership.

At a press conference, Powell acknowledged that inflation may remain high for longer than expected and that a rate hike at every FOMC meeting this year is not out of the question.

Against this background, US stocks quickly lost all gains for the day and closed in negative territory on Wednesday: the S&P 500 lost 0.15%.

The index also ended yesterday's trading with a decrease (by 0.54%) after the initial growth.

On Thursday, traders continued to evaluate the results of the January Fed meeting.

The range between the highest and lowest values of the indicators reached the day before was not as significant as in previous sessions this week, but continued to indicate the persistence of volatile market sentiment.

Initially, investors reacted positively to the report, which reflected the growth of American GDP at the highest pace in almost 40 years in the fourth quarter. However, subsequently, the S&P 500 index was again under pressure, including the realization that the impressive economic growth in the United States was caused by low interest rates, pent-up demand and a huge fiscal stimulus package of $1.9 trillion.

by some signs, the growth rate of national GDP is already slowing down. According to the latest survey of purchasing managers, activity in the US service sector has fallen to an 18-month low. Retail sales in the country declined sharply in December. Consumer confidence is also at a low level. Although some events can be explained by the recent outbreak of Omicron, this may also indicate a decline in underlying demand.

In addition, there are fears that the easy money that supports stocks will be gradually withdrawn, and corporate profits will decrease on both sides – due to a slowdown in income growth amid a downturn in the economy, as well as due to an increase in wage costs.

The US stock market ends the current week on a minor note, and experts disagree about its future prospects.

While some analysts believe that the sell-off is nearing its final stage, others predict an even bigger drop in stocks.

Goldman Sachs analysts believe that it's time to buy, as after the decline in the prices of many stocks have reached attractive levels.

[img]https://forex-images.ifxdb.com/userfiles/20220128/analytics61f439aa3e61b_source!.jpg[/img]

"Any further significant weakness in the S&P 500 index should be considered as a buying opportunity, from our point of view, although with moderate growth potential during the year as a whole," the bank's specialists said.

"The Fed will raise interest rates in 2022 to tame rising inflation, which is close to a 40-year high, but the central bank is likely to raise rates to a relatively low level," they added.

According to the forecast of Goldman Sachs, the S&P 500 index will grow to 5,000 points by the middle of the year, and by the end of the year it will rise to 5,100 points.

The sell-off on the US stock market is at the last stage, as investors' concerns about the federal funds rate hike and weak company profits are exaggerated, analysts at JPMorgan believe.

"If the stock market sell-off continues, the Fed could potentially change its policy to stop the fall. Easing expectations on the pace of interest rate hikes this year or delaying plans to reduce the Fed's balance sheet will help return investors' interest in risky assets," they said.

Following the results of the FOMC meeting and the press conference, Powell's futures market quickly put into quotes expectations of another, fifth, increase in the federal funds rate this year. This event triggered the decline of the S&P 500.

, due to fears of a real collapse of the US stock market, the Fed will raise rates only three times this year, economists at Mizuho Bank believe.

Meanwhile, Morgan Stanley strategists claim that the correction in the US stock market is not over yet.

They predict that the S&P 500 index could fall another 10% from current levels and drop below 4,000 points over the next three to four weeks.

"Apparently, investors underestimate the consequences of tightening monetary policy in the United States, as well as the potential slowdown in economic growth in the country. Therefore, we recommend doubling the share of investments in protective assets before the upcoming correction in the market," the bank noted.

flight from risky assets, provoked by the results of the January Fed meeting, led not only to the fall of the S&P 500, but to the rally of the US dollar against all major competitors.

Over the past week, the greenback has added about 1.8% to the euro, almost 2% to the antipodes, and the USD index has risen above 97 for the first time since July 2020.

"Powell made it clear that the increase in interest rates and the reduction of the balance sheet may occur faster than during the previous tightening cycle. We expect further growth of the dollar against the background of normalization of monetary policy in the United States, and the January FOMC meeting should give it an additional impetus," HSBC analysts said.

The US currency may well move to the next target in the 97.70–98.00 zone, beyond which there are practically no technical resistances up to the 100.00 mark, according to OCBC Bank.

It should be noted that the greenback did not start the current year well and initially defied the overwhelming consensus that it should strengthen, but then it was able to get up from its knees and is now close to showing the best week in the last seven months.

On Friday, the USD index updated 19-month highs in the area of 97.40-97.45, after which the bullish momentum weakened somewhat, but remains, which means that the markets continue to put more aggressive Fed rate hikes in quotes.

Some experts believe that after the "dust" settles down regarding the prospects for rates, the dollar rally will begin to run out of steam.

"The greenback is at cyclical highs, and it needs to move on, as the differential of interest rates and the increased level of market volatility provide support for the US currency. However, this is most likely the last stage of the USD movement," Societe Generale strategists said.

"There is a possibility that the global economy will come out of the worst period of the COVID-19 pandemic this year, and the market focus will shift to the normalization of monetary policy and growth outside the United States. In such a scenario, the best yield of the currency in the second half of this year will be obtained outside the world's largest economy," they added.

Wednesday, Powell not only left the door open to raising rates faster than in previous cycles, but also warned that the balance sheet reduction would be significant.

However, the question arises: how much will inflation fall in response to the first rounds of policy tightening. And will that be enough?

If price pressure is able to ease quickly, the Fed's mood may turn out to be less hawkish, which will allow stocks to breathe a sigh of relief, and the greenback will be under pressure.

However, if aggressive efforts of the US central bank are required to reverse the price trend, the tone of its statements will be "belligerent", which may frighten the market and will increase expectations of further rate hikes, which in turn will support the dollar.

At the same time, it is difficult to predict the consequences that such sharp increases in interest rates and such powerful asset sales from the Fed's balance sheet will lead to.

A popular harbinger of a recession in the United States - the spread between 10- and 2-year government bonds - has fallen to a low since November 2020 mainly due to the fact that short-term yields jumped, and long-term yields barely moved places, hinting that some traders consider the position of the US central bank slightly reckless and begin to put the hawkish error of the Fed in quotes.

If a serious collapse in the US stock market begins, which will increase the risks of a sharp slowdown in economic growth in the country, the central bank will have no choice but to soften the rhetoric at some point.

There are some more good news that investors can cling to. Omicron may be the last wave of the pandemic. As it weakens, the problems in the labor market related to inflation may disappear.

All th

"If market expectations regarding central banks continue to grow in general, the ECB's capitulation in the context of the need to raise rates may be a turning point that will support the euro, however, this moment has not yet come. If longer-term yields in the US remain anchored, we will not necessarily see a rapid drop down. But in the future, either tightening by the Fed will bring down the markets, or the same shift in ECB policy will come," they added.

On Friday, the EUR/USD pair updated a 20-month low around 1.1125 before recovering to 1.1170. \

Divergence in the rates of the ECB and the Fed is likely to limit the growth of EUR/USD and allow the pair to continue to decline, at least until the key ECB meeting in March, Westpac analysts say.

"The chart of the yield spreads of two-year US and European government bonds clearly reflects the direction of this divergence. It should persist unless the ECB announces the end of PEPP and revises policy and economic forecasts in March. The inability of the EUR/USD pair to settle above 1.1400 in January may cause testing of 1.1000-1.1050," they believe.

The jump in short-term rates in the US due to the hawkish position of the Fed has led the EUR/USD pair to new cycle lows, and it seems that the test of the 1.1000 level is only a matter of time, ING economists note.

On the eve of the ECB meeting, which will be held next Thursday, the consumer price index in the eurozone for January will be released. The indicator is expected to reach 4.3% year-on-year, as some of the underlying effects will disappear. More clear signs that inflation peaked at 5% in December are unlikely to force the ECB to take a more aggressive stance. Since the European Central Bank does not support short-term interest rates in the eurozone, the EUR/USD pair will remain at the mercy of the Fed's policy tightening cycle," they said.

"The downward momentum in the euro was reinforced by the hawkish update of the Fed's policy. The head of the US central bank, J. Powell has opened the door for faster rate hikes than during the previous tightening cycle. Recent events confirm our forecast of a decline in the EUR/USD pair to 1,1000 in the first quarter. The downward pressure on the pair may increase in the near future if tensions between Russia and Ukraine increase. However, in the coming week, the bearish trend in the euro will be challenged if the ECB does not provide such strong resistance to expectations of an interest rate increase this year," MUFG Bank said.

The main currency pair has not yet managed to launch a convincing recovery, and it looks vulnerable due to the continuing divergence in the rates of the ECB and the Fed, which continues to support the outflow of capital from the eurozone. In this regard, attempts to increase EUR/USD can still be regarded as a convenient opportunity for short positions.

The initial resistance is at 1.1185. Its breakout may trigger a short squeeze, although growth may be stopped near the 1.1230 mark, which will be a key turning point for short-term traders. Its clean breakdown will lay the foundation for further recovery of the pair.

The nearest support is located around 1.1100, the breakdown of which will allow the bears to aim for 1.1050 and 1.1000.

is will have a negative impact on the defensive greenback, but for now it is determined and strong enough to challenge his main competitors.

The rally of the US currency has already led to the fact that the EUR/USD pair has sunk to the levels it last visited in June 2020.

"The main currency pair collapsed as the market was forced to assess the risk that the Fed could implement a larger rate hike this year than initially expected. This happened after the announcement of the results of the January FOMC meeting and the press conference of Powell. Meanwhile, signals from key members of the ECB board of directors continue to indicate that the central bank intends to adjust monetary policy gradually, believing that inflation will be transient," analysts at Saxo Bank noted.

-

01-02-2022, 06:26 AM #2876

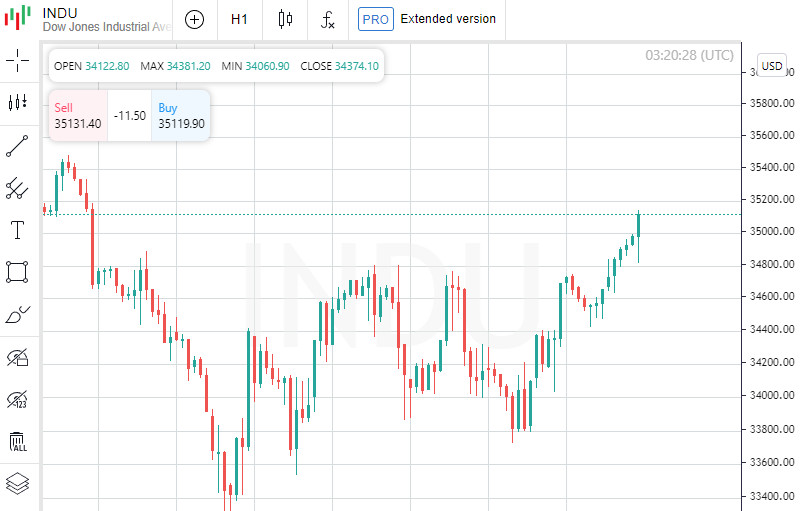

US stock market closes higher, Dow Jones gains 1.17%

At the close in the New York Stock Exchange, the Dow Jones was up 1.17%, the S&P 500 was up 1.89% and the NASDAQ Composite was up 3.41%.

The leading gainer among the components of the Dow Jones index today was Boeing Co, which gained 9.67 points or 5.07% to close at 200.24. Salesforce.com Inc rose 10.50 points or 4.73% to close at 232.63. The Walt Disney Company rose 4.34 points or 3.13% to close at 142.97.

The biggest losers were Walgreens Boots Alliance Inc, which shed 0.70 points or 1.39% to end the session at 49.76. Amgen Inc was up 0.87% or 2.00 points to close at 227.14, while Visa Inc Class A was down 0.80% or 1.83 points to close at 226. ,17.

Leading gainers among the S&P 500 index components in today's trading were Enphase Energy Inc, which rose 13.41% to 140.47, SolarEdge Technologies Inc, which gained 12.33% to close at 238.22, and also shares of Netflix Inc, which rose 11.13% to end the session at 427.14.

L3Harris Technologies Inc led the decline, shedding 4.29% to close at 209.29. Shares of Kellogg Company shed 3.46% to end the session at 63.00. Quotes of Citrix Systems Inc decreased in price by 3.42% to 101.94.

Leading gainers among the components of the NASDAQ Composite in today's trading were Calithera Biosciences Inc, which rose 55.65% to hit 0.650, Inspira Technologies Oxy BHN Ltd, which gained 36.52% to close at 3.14, and also shares of Vaccinex Inc, which rose 33.63% to close the session at 1.510.

The drop leaders were shares of Imperial Petroleum Inc, which lost 55.05% to close at 0.98. Shares of Appharvest Inc lost 12.06% to end the session at 2.99. Quotes of Vigil Neuroscience Inc decreased in price by 11.95% to 12.90.

On the New York Stock Exchange, the number of securities that rose in price (2,680) exceeded the number of those that closed in the red (574), while quotes of 106 shares remained virtually unchanged. On the NASDAQ stock exchange, 3323 companies rose in price, 582 fell, and 154 remained at the level of the previous close.

Imperial Petroleum Inc shares tumbled to historic lows, down 55.05% or 1.20 points to close at 0.98. Shares in Appharvest Inc plunged to all-time lows, shedding 12.06% or 0.41 points to close at 2.99.

The CBOE Volatility Index, which is based on S&P 500 options trading, fell 10.23% to 24.83.

Gold Futures for February delivery added 0.76%, or 13.60, to $1,798.50 a troy ounce. In other commodities, WTI crude for March delivery rose 1.49%, or 1.29, to $88.11 a barrel. Brent oil futures for April delivery rose 0.07%, or 0.06, to $89.28 a barrel.

Meanwhile, in the Forex market, EUR/USD was down 0.00% to hit 1.1233, while USD/JPY was up 0.03% to hit 115.14.

Futures on the USD index fell 0.65% to 96.632.

News are provided by

InstaForex.

-

02-02-2022, 12:09 PM #2877

US dollar is torn between recession and attempts to rise

This week has not been set for the US currency. It fell due to the probability of disappointing macro statistics and the short-term strengthening of the euro. However, it does not give up, trying to leave the price hole.

On Tuesday, the US dollar collapsed from a 19-week high. It is declining for the second session in a row, unsuccessfully trying to stay above. There are several reasons for the decline – the expectation of the Fed's rate hike, increased cash flows at the end of January, due to which investors have to sell dollars and an increase in risk appetite. At the end of last month, the risk appetite in the markets increased significantly. The catalyst for this was the rebalancing of investors' portfolios and their move into protective assets.

American macro statistics provided temporary support for the US dollar. Last month, the index of business activity in the industry of the country declined to 57.6% from the previous 58.7% and analysts' expected fall of 57.5%. Currently, markets are waiting for signals from the European regulator, as the US has already did an action, marking the course for tougher monetary policy.

According to experts, the US dollar's decline was facilitated by market fears about a possible reduction in the gap between the ECB and the Fed. Some analysts suggest that the European regulator will raise rates before the American one. At the same time, the markets are not confident that the Fed will raise rates five times this year. It can be recalled that the US regulator has repeatedly had to change its plans. Nevertheless, the market is still counting on a five-fold increase in the Fed's rates, the first of which is expected in March. As for the ECB, it is still adhering to the ultra-soft monetary policy, refusing to raise rates this year.

The current situation helped the EUR/USD pair to rise, while the US currency remained under pressure. The strengthening of the euro became a powerful driver of trading, which was facilitated by Inspiring reports on consumer prices in Germany. Experts admit a reversal in the direction of 1.1300-1.1350. According to currency strategists, the next target of the EUR/USD pair will be the level of 1.1300. The formation of the bullish pattern "Morning Star", fixed on the chart on Tuesday, contributed to this. On Wednesday morning, the EUR/USD pair was hovering around 1.1274, approaching the specified level.

Currency strategists cite the flattening of the yield curve as among the reasons for the US dollar's current weakness. A flat curve is a sign of an impending recession, while an inverted curve indicates a recession in the economy. Economists estimate that the US yield curve is gradually flattening, while the yield spread between 2-year and 10-year bonds is narrowing (to a minimum since October 2020). This worries experts who see an analogy with December 2018, when the Fed completed its cycle of raising rates, increasing the rate to 2.5%. At this time, the regulator began to reduce the balance sheet, and it now aims to take similar actions. However, the result may not meet market expectations.

According to analysts, the flattening yield curve indicates that the debt market is counting on a solution to supply chain problems. If the issue is resolved, the Fed will not need an aggressive series of rate hikes. However, the market is worried that the rate hike will not allow the Fed to contain price pressure. It is possible that the "hawkish" position of the US regulator, faced with a similar position to the European one, will strike a spark in their relationship. This week's positivity will be the strengthening of the euro against the US dollar, which market participants expect.

News are provided by

InstaForex.

-

03-02-2022, 08:01 AM #2878

Eurozone inflation hits record fueling bets ECB could raise interest rates

The euro may continue its rally. On Wednesday, the currency broke through 1.1300. Despite the dovish ECB, macroeconomic data indicate a possible shift towards a more aggressive stance. Record inflation may force the European regulator and Christine Lagarde to consider tightening. Consumer prices in the eurozone continue to increase rapidly, in line with analysts' expectations.

The annual inflation rate in the eurozone edged higher to a fresh record high of 5.1% in January from 5% in December. The market had not expected such an outcome. Neither of Bloomberg's respondents had anticipated another inflation rike. On the contrary, investors had projected a 4.4% slowdown in the rate.

The data came out before the ECB's Governing Council meeting. Therefore, a disagreement may arise over the pace of QE tapering among the council members. There has been speculation that another unexpected inflation hike will be a kind of test for the European regulator.

The euro's reaction to the inflation report was brief. The currency is unlikely to rise solely on these data. However, if the ECB adopts a hawkish stance, the euro will show steady growth.

Market participants expect the regulator to announce the first rate hike by the end of the year. Meanwhile, the ECB fiercely denies such a possibility. Let's see what the regulator says on Thursday.

Anyway, activity in markets increased after the release of the inflation report and the euro's reaction to it. Analysts started to revise their forecasts for EUR/USD. Scotiabank assumes the quote will head towards 1.1400 and break above the mark.

The euro has potential for growth despite the current corrective move. If buyers show willingness to extend the uptrend, the target levels will stand at 1.1369 (the high of January 20) and 1.1430 where the 100-day EMA and the 4-month resistance line intersect.

Meanwhile, the long-term forecast is likely to remain bearish as long as the price trades below the key 200-day SMA.

Read More: https://www.instaforex.eu/forex_analysis/301657

News are provided by

InstaForex.

-

04-02-2022, 08:39 AM #2879

Pound aims to reach new highs

The pound gathered strength for the next breakthrough, which occurred after the results of the Bank of England's meeting on the rate was announced. Its nearest goals are to consolidate in the reached positions and conquer the next highs.

On Thursday, the Bank of England discussed the current monetary policy. The key issue was to raise the interest rate. The markets expect five rate hikes from the regulator this year, the cumulative increase of which will be 125 bps. Following the announcement of the results of the meeting, the pound noticeably declined against the US dollar. On Thursday evening, it was trading at the level of 1.3577 and then made a short-term breakthrough to 1.3628. However, it lacked the strength to hold on to the gained positions. On Friday morning, the GBP/USD pair was near the round level of 1.3600, trying not to further fall.

Experts consider the Bank of England one of the most "hawkish" among the world's regulators. The actions of the monetary authority confirm this definition. It can be recalled that the British regulator is expected to increase the interest rate from 0.25% per annum to 0.5% while maintaining the volume of asset repurchases for 895 billion pounds. Along with this, the Bank of England revised the forecast of the country's economic growth downward to 3.75% from the previous 5% calculated in November 2021. The Central Bank of England considers a reduction in aggregate demand as the reason for the slow growth rates of the national economy. At the same time, the regulator raised the forecast for UK inflation for this year to 5.75% from the previous 3.5%.

The current situation had a vague effect on the pound's dynamics. On the one hand, the rate increase gave impulse to it, helping it to increase, but on the other hand, it keeps it in a state of uncertainty. This condition prevents the pound from reversing and it has to be content with short-term growth.

In relation to the Euro currency, the British currency also showed growth. Analysts noted that it surged to a 2-year high against the euro amid the interest rate hike by the Bank of England. The regulator expectedly raised the key rate to 0.5%, and this is not the limit. According to Jane Foley, Head of Foreign Exchange at Rabobank, the Bank of England will raise rates again in May 2022.

"Against the backdrop of falling household incomes due to rising energy and food prices, market expectations for a rate hike by the Bank of England are exaggerated. However, another rate hike is expected in May," J. Foley believes.

The British regulator has increased the interest rate to curb rampant price pressure. According to the estimates of the Central Bank of England, the inflation rate in the country will soon exceed 7%. The off-the-scale indicators not only concern inflation. According to BoE's representatives, consumer price growth in April 2022 will reach its peak values over the past 30 years and will amount to 7.25%. Based on the preliminary forecasts, the UK inflation will remain above 5% in a year. However, the ministry believes that inflation will be below 2% in three years and will amount to 1.6%. At the same time, the British regulator believes that investors have put too many rate increases in prices this year.

Because of this, the pound remains at risk but does not give up. It is slightly imbalanced against the US dollar due to a decline in global risk appetite and a drop in the stock market, but it strives to overcome price barriers, despite inflationary pressure and several negative economic factors.

News are provided by

InstaForex.

-

07-02-2022, 09:51 AM #2880

Euro and US dollar's main concern is to reach new highs

The price highs that the euro reached last Friday are not the limit for it. It aims to break through new barriers. At the same time, the US dollar is set up in a similar way, which is waiting for the Fed's help.

The Euro currency started the new week with the high reached over the past three weeks, but there is one problem – a small correction. Last Friday, the single currency approached a three-week high and is trying to hold on to its gained positions. The reason for the surge was a hawkish reversal in ECB policy. However, experts believe that the euro's further growth is unlikely amid the impending tightening of the Fed's monetary policy. In such a situation, the US dollar will take the lead. Analysts are sure that the US currency will need the Fed's tightening of monetary policy to further rise.

Experts believe that the EUR/USD pair is in for serious changes. The first step along this path was the change in ECB's monetary policy. Earlier, the European regulator confidently defended its position, planning to maintain the current interest rate until the end of 2022. However, the situation has changed dramatically now as the ECB revised its strategy during its last meeting. According to analysts, the regulator will update the previous inflation forecast and abandon the current dovish position at the March meeting. Experts allow similar actions by the ECB following the results of the June meeting.

The current situation contributed to the euro's sharp growth across the entire market. The US dollar followed suit, although its results were more modest. Against the backdrop of impressive US macroeconomic data, the market's expectations regarding the tightening of the monetary policy have intensified. Analysts said that the Fed can immediately raise the rate by 50 basis points (bp) next month. In such a situation, the US currency will get a head start and can bypass the euro.

The general upswing that swept the markets contributed to the growth of the EUR/USD pair. At the end of last week, the pair was steadily gaining momentum. Its vector is still directed up, despite the short-term decline. On Monday morning, the EUR/USD pair was around the level of 1.1432. Some instability was caused by the euro's downward correction, recorded after a 2% increase against the US dollar.

The US currency is gaining momentum amid a noticeable strengthening of the US labor market and the upcoming Fed rate hike. The sharp rise in the euro did not prevent the dollar from strengthening its position and adding 0.4%. According to experts, the US dollar's growth will continue soon.

According to the US Department of Labor report, the US labor market has risen. The increase in jobs in the country last year amounted to 467 thousand against the projected 150 thousand. The data for December 2021 was also revised upwards. As a result, the increase in the number of employees amounted to 510 thousand against the previously forecasted 211 thousand.

The publication of impressive data contributed to the growth of market expectations regarding the Fed rate hike by 50 bps at once in March. In such a situation, the US dollar will sharply increase, although experts fear a negative impact on it from the debt market. It can be recalled that the EUR/USD pair collapsed to 1.1411 after the release of reports on the US labor market, and then returned to 1.1450. According to preliminary estimates, the pair will stabilize "sideways" from the range of 1.1400 - 1.1600 in the upcoming weeks.

The market's paradoxical reaction to the impressive US data confused experts. Experts explain this by the difficult situation that has developed in the American debt market. The increased expectation of tightening the monetary policy brought down the price of state bonds.

The untwisted spring of these expectations hit the yield of 10-year bonds. As a result, their cost soared to 1.93%, updating the high since December 2019. At the same time, analysts are sure that the US Treasury will not allow the collapse of the USD and the debt market. The agency needs to place an additional $350 billion to maintain the balance in the system and stabilize the US dollar.

News are provided by

InstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 11 users browsing this thread. (0 members and 11 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote