the risks that exist must be able to be considered properly, this is done so that traders can become more leverage in surviving and can become traders of the month with Tickmill.

Please visit our sponsors

Results 3,021 to 3,030 of 3458

Thread: Forex News from InstaForex

-

06-09-2022, 05:04 AM #3021

-

06-09-2022, 10:42 AM #3022

Euro, move forward: the dollar has slowed down! EUR/USD ineptly puts pressure on gas

The euro seeks to wrap itself in favor of the gas problems faced by the countries of the eurozone. Most often, the EUR loses, but now there is a small chance for its short-term recovery amid a slowing USD rally.

The greenback took a breather on the morning of Tuesday, September 6, to recover from a heady rally. This strategy has led to some decline from all-time highs against the euro, but it is still too early to draw conclusions. The threat of a recession looms over both currencies. Adding fuel to the fire is the high likelihood of a sharp rise in US interest rates.

A short-term slowdown in the growth of the USD against key currencies and a slight subsidence against the European one was caused by expectations of statistical data on the index of business activity in the US services sector (ISM). According to preliminary estimates, this figure fell to 55.1% in August from 56.7% in July. Significant support for the US currency is provided by expectations about the rate hike by the Federal Reserve. According to analysts, the central bank is "at a low start" in this matter. At the same time, 62% of specialists include in prices its increase by an additional 0.75 percentage points, up to 3-3.25% per annum.

In such a situation, the dynamics of the euro, which has to withstand the gas crisis in the eurozone, is in distress. At the beginning of this week, the euro fell by 0.7% to 0.9880. According to experts, this is the lowest figure in the last 20 years. The current energy crisis has seriously shaken the euro's position. The driver of this fall was the actions of the Russian authorities, who announced a complete suspension of the supply of natural gas through the Nord Stream pipeline. According to analysts, this will increase the economic problems of European businesses and households.

Against this background, mass short positions on the European and British currencies were recorded. Experts fear that this trend will strengthen. According to currency strategists at ING Bank, "gas pressures sent the EUR/USD pair to new lows this year." Recall that earlier this week, the pair fell below 0.9900 for the first time since October 2002.

According to ING economists, in the near future the EUR/USD pair will continue to fall to a new support level in the range of 0.9600-0.9650. However, this is an extremely low level for a pair, which threatens the existence of the single currency. The EUR/USD pair cruised near 0.9963 on the morning of Tuesday, September 6, winning back previous losses. However, experts warn against euphoria, as the dollar is ready to brace itself and continue its rally, displacing the euro.

In such a situation, many analysts see a way out in a further increase in the key rate by the European Central Bank. However, ING economists do not agree with this, who consider it excessive to raise the rate by the central bank by 75 bps at once. According to experts, this will not solve the current problems of the eurozone. ING bank believes that the rate hike by 75 bps at the next meeting, scheduled for Thursday, September 8, is "too big a step for the ECB, which will not help the euro." You should expect it to increase by 50 bps, analysts conclude.

Expectations about a sharp rate hike by the ECB (by 75 bps) are fueled by growing inflation in the euro area, the threat of a recession and disappointing macroeconomic data for the region. The icing on the cake was the deepening of the energy crisis in Europe. This undermines the demand for a single currency, experts emphasize. According to current reports, in July, retail sales in the euro area fell by 0.9% in annual terms. At the same time, markets expected a decline of 0.7%. In addition, the Sentix investor confidence index fell to -31.8 points in September from -25.2 points in August. Against this backdrop, Sentix analysts noted a "clear deterioration" in the economic situation in the eurozone, stressing that this is the lowest rate since May 2020.

The US currency continues to benefit from the current situation, despite a short-term subsidence. Many experts agree on the long-term upward trend of the dollar, which has been observed since mid-2021. Experts believe that a significant divergence in the monetary strategies of central banks is a significant driver of the growth of the USD against the euro. It is noted that the ECB is still "two steps behind the Fed" in terms of raising rates. The situation was not saved even by its increase by 50 points in July. However, the ECB may revise its strategy and raise the rate at the next meeting by 50-75 bps.

Another important factor in the greenback's growth is the stability of the US economy. According to analysts, the US is relatively easy to survive the gas crisis, while selling energy to Europe. In the long term, this state of affairs plays against the ECB and the countries of the European bloc, but it plays into the hands of the Federal Reserve. In such a situation, it is difficult for the ECB not only to raise, but also to keep rates at a high level, unlike the Fed. Under such a scenario, a deep economic downturn in the eurozone is possible, experts warn.

The current market environment creates a bullish outlook for the dollar index (USDX). Currently, the bulls on the dollar are in a strong position, pushing the bears. However, the situation may change at any time. In the short and medium term, analysts allow it to rise to an impressive 120 points, that is, an increase of 9%. In a favorable scenario, USDX will head towards the peaks of 2001-2002. However, experts consider this option extreme, although they allow its implementation until the end of 2022.

News are provided by

InstaForex.

Read More

-

07-09-2022, 09:28 AM #3023

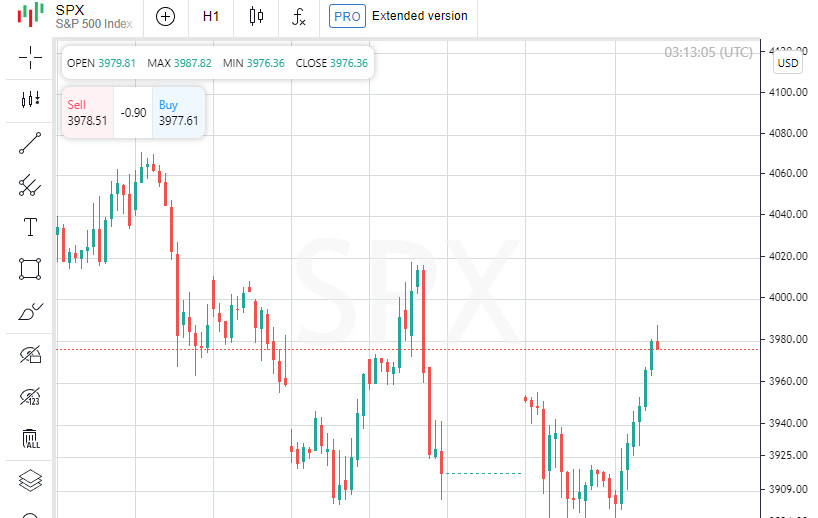

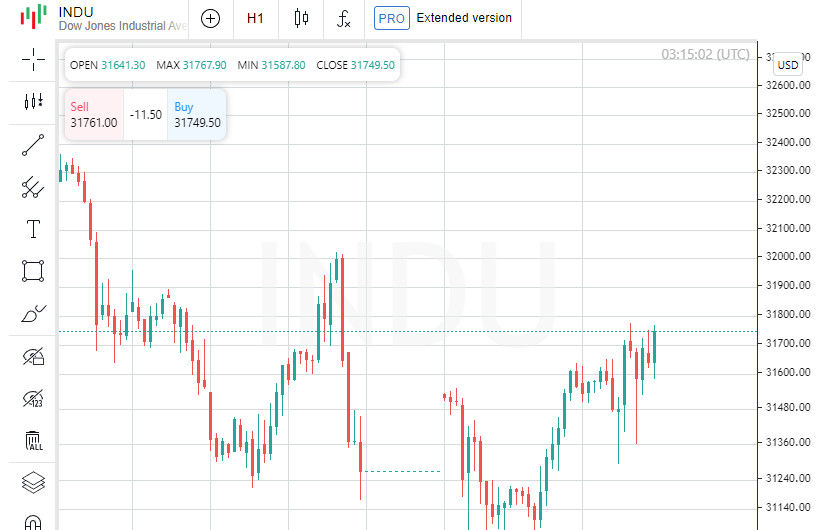

US stocks closed lower, Dow Jones down 0.55%

At the close on the New York Stock Exchange, the Dow Jones fell 0.55% to a one-month low, the S&P 500 fell 0.41%, and the NASDAQ Composite fell 0.74%.

The leading performer among the components of the Dow Jones index today was Visa Inc Class A, which gained 0.88 points (0.45%) to close at 198.64. Boeing Co rose 0.57 points (0.38%) to close at 152.39. Johnson & Johnson rose 0.44 points or 0.27% to close at 163.18.

The losers were 3M Company, which shed 5.05 points or 4.15% to end the session at 116.60. Intel Corporation was up 2.75% or 0.86 points to close at 30.36, while Goldman Sachs Group Inc was down 1.51% or 4.99 points to close at 326. .49.

Leading gainers among the S&P 500 index components in today's trading were Rollins Inc, which rose 6.05% to 35.78, Enphase Energy Inc, which gained 4.93% to close at 292.82, and SolarEdge Technologies Inc, which rose 4.22% to end the session at 278.38.

The biggest losers were Moderna Inc, which shed 6.13% to close at 130.08. Shares of Church & Dwight Company Inc shed 4.69% to end the session at 80.23.

Leading gainers among the components of the NASDAQ Composite in today's trading were Shuttle Pharmaceuticals Inc, which rose 91.28% to hit 28.50, IVERIC bio Inc, which gained 66.31% to close at 15.70, and also shares of HyreCar Inc, which rose 58.12% to end the session at 1.27. Shares of Creatd Inc were the biggest losers, losing 48.11% to close at 0.19.

Shares of Addentax Group Corp lost 39.52% and ended the session at 5.80. Quotes of Rigetti Computing Inc decreased in price by 37.09% to 2.29.

On the New York Stock Exchange, the number of securities that fell in price (2121) exceeded the number of those that closed in positive territory (1009), while quotes of 117 shares remained virtually unchanged. On the NASDAQ stock exchange, 2,468 companies fell in price, 1,299 rose, and 194 remained at the level of the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, rose 3.54% to 26.91, hitting a new monthly high.

Gold futures for December delivery lost 0.62%, or 10.75, to hit $1.00 a troy ounce. In other commodities, WTI October futures fell 0.14%, or 0.12, to $86.75 a barrel. Brent oil futures for November delivery fell 3.19%, or 3.05, to $92.69 a barrel.

Meanwhile, in the Forex market, the EUR/USD pair remained unchanged 0.24% to 0.99, while USD/JPY edged up 1.58% to hit 142.80.

Futures on the USD index rose 0.66% to 110.24.

News are provided by

InstaForex.

Read More

-

08-09-2022, 07:52 AM #3024

US stock market closes higher, Dow Jones gains 1.40%

At the close in the New York Stock Exchange, the Dow Jones rose 1.40%, the S&P 500 index rose 1.83%, the NASDAQ Composite index rose 2.14%.

The leading performer among the components of the Dow Jones index today was 3M Company, which gained 3.95 points or 3.39% to close at 120.55. Nike Inc rose 3.33 points or 3.17% to close at 108.48. Home Depot Inc rose 2.74% or 7.93 points to close at 297.47.

The biggest losers were Chevron Corp, which shed 2.01 points or 1.28% to end the session at 155.11. Verizon Communications Inc was up 0.02 points (0.05%) to close at 41.08, while Caterpillar Inc was up 0.20 points (0.11%) to close at 180. 86.

Leading gainers among the S&P 500 index components in today's trading were SolarEdge Technologies Inc, which rose 11.85% to 311.36, Enphase Energy Inc, which gained 8.02% to close at 316.31, and also shares of DexCom Inc, which rose 7.73% to end the session at 88.37.

The biggest losers were APA Corporation, which shed 3.04% to close at 36.67. Shares of Old Dominion Freight Line Inc shed 2.95% to end the session at 263.98. Quotes of Halliburton Company decreased in price by 2.85% to 28.68.

Leading gainers among the components of the NASDAQ Composite in today's trading were Imara Inc, which rose 71.79% to hit 2.01, Shuttle Pharmaceuticals Inc, which gained 27.72% to close at 36.40, and shares of Spero Therapeutics Inc, which rose 26.55% to end the session at 1.43.

The biggest losers were Cleantech Acquisition Corp, which shed 28.36% to close at 6.77. Shares of Newage Inc lost 25.20% and ended the session at 0.09. First Wave BioPharma Inc (NASDAQ:FWBI) was down 23.22% to 3.24.

On the New York Stock Exchange, the number of securities that rose in price (2,400) exceeded the number of those that closed in the red (723), while quotes of 131 shares remained virtually unchanged. On the NASDAQ stock exchange, 2715 companies rose in price, 1027 fell, and 217 remained at the level of the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, fell 8.44% to 24.64.

Gold futures for December delivery added 0.92%, or 15.70, to $1.00 a troy ounce. In other commodities, WTI October futures fell 5.96%, or 5.18, to $81.70 a barrel. Brent oil futures for November delivery fell 5.70%, or 5.29, to $87.54 a barrel.

Meanwhile, on the Forex market, EUR/USD rose 1.08% to hit 1.00, while USD/JPY edged up 0.72% to hit 143.82.

Futures on the USD index fell 0.62% to 109.52.

News are provided by

InstaForex.

Read More

-

09-09-2022, 09:09 AM #3025

US stocks close higher, Dow Jones gains 0.61%

At the close of the New York Stock Exchange, the Dow Jones rose 0.61%, the S&P 500 rose 0.66% and the NASDAQ Composite rose 0.60%.

Salesforce.com Inc was the leading gainer among the components of the Dow Jones index today, up 3.62 points or 2.36% to close at 156.90. JPMorgan Chase & Co rose 2.70 points or 2.33% to close at 118.60. Goldman Sachs Group Inc rose 4.82 points or 1.46% to close at 335.38.

The losers were 3M Company shares, which lost 1.28 points or 1.06% to end the session at 119.27. Apple Inc was up 1.51 points (0.97%) to close at 154.45, while Honeywell International Inc was down 1.27 points (0.67%) to close at 187. 82.

Leading gainers among the S&P 500 index components in today's trading were Regeneron Pharmaceuticals Inc, which rose 18.85% to 708.85, Freeport-McMoran Copper & Gold Inc, which gained 7.89% to close at 30 .62, as well as shares of Invesco Plc, which rose 4.77% to close the session at 17.36.

The biggest losers were McCormick & Company Incorporated, which shed 6.71% to close at 79.30. Shares of Kraft Heinz Co lost 3.38% to end the session at 36.06. Quotes Campbell Soup Company fell in price by 2.98% to 47.84.

Leading gainers among the components of the NASDAQ Composite in today's trading were ShiftPixy Inc, which rose 176.54% to 31.00, Amylyx Pharmaceuticals Inc, which gained 51.01% to close at 27.03, and shares of Rubius Therapeutics Inc, which rose 48.58% to close the session at 1.29.

The drop leaders were Troika Media Group Inc, which shed 26.83% to close at 0.48. Shares of Ensysce Biosciences Inc shed 17.71% to end the session at 0.33. Quotes of Biophytis fell in price by 17.67% to 0.91.

On the New York Stock Exchange, the number of securities that rose in price (1,743) exceeded the number of those that closed in the red (1,342), and quotes of 154 shares remained virtually unchanged. On the NASDAQ stock exchange, 2274 companies rose in price, 1485 fell, and 268 remained at the level of the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, fell 4.18% to 23.61.

Gold Futures for December delivery lost 0.47%, or 8.20, to hit $1.00 a troy ounce. In other commodities, WTI October futures rose 0.99%, or 0.81, to $82.75 a barrel. Brent oil futures for November delivery rose 0.59%, or 0.52, to $88.52 a barrel.

Meanwhile, in the Forex market, the EUR/USD pair remained unchanged, 0.01% to 1.00, while USD/JPY was up 0.25% to hit 144.05.

Futures on the USD index fell 0.17% to 109.65.

News are provided by

InstaForex.

Read More

-

12-09-2022, 09:56 AM #3026

EUR/USD: price tug of war continues

The US and European currencies remain in the stage of confrontation, intensely competing with each other. However, the euro often loses in this race, periodically losing to the stronger dollar. Against this background, analysts expect parity in the EUR/USD pair to be maintained in the short and medium term planning horizons.

The euro jumped at the beginning of the new week, rising slightly thanks to the European Central Bank's hawkish signals. The euro reached a three-week high against the US currency, as representatives of the ECB decided to stick to an aggressive tightening of monetary policy.

Recall that following the results of the next meeting, the ECB raised its key rate to a record 75 bps. These are quite decisive actions taken after the July rate hike by 50 bps, etc. Such a move was included in the debt market quotes, so it did not come as a surprise. According to analysts, the hawkish tone of the central bank provided significant support to the single currency, although this did not save it from another fall below the parity level. The EUR/USD pair was trading at 1.0088 on Monday morning, September 12, partly recouping previous losses.

According to ECB President Christine Lagarde, "a weak euro spurs inflation." Against this background, more drastic steps in the process of raising the rate are acceptable in the near future. Representatives of the central bank also noted that its next rises are possible at the next five meetings. In addition, the next two official events will end with an increase in rates, according to the department.

Against this background, the US currency plunged slightly against the European one in anticipation of reports on the US inflation rate (CPI). On Tuesday, September 13, markets will focus on data on annual US inflation. According to preliminary forecasts, in August, the growth of consumer prices in the United States will show a slowdown for the second consecutive month (from the current 8.5% to 8.1%). At the same time, investors and traders expect that in September the Federal Reserve will raise the discount rate by another 75 bps. This opinion is held by 90% of analysts, and the remaining 10% expect a rate increase to 50 bps.

Some experts consider the deterioration of the August CPI indicators in the United States to be one of the potential risks of a decline in the greenback. According to analysts, another weak macroeconomic report casts doubt on market expectations for a third consecutive rate hike of 75 bps. However, some experts are optimistic. Wells Fargo currency strategists believe that despite the aggressive pace of tightening of the monetary policy by a number of central banks, the Fed will remain the leader in this matter. Against this background, it is quite possible to strengthen the USD until the end of 2022, analysts say.

A similar position is held by Larry Summers, a former US Treasury Secretary and current professor at Harvard University. He believes that the greenback has excellent chances for further strengthening. At the same time, the specialist takes into account a number of fundamental factors contributing to the growth of the latter. According to Summers, America has a "huge advantage": it does not depend on "extremely expensive foreign energy carriers." An additional advantage is the fact that the Fed is moving towards tightening monetary policy faster than other central banks. "This allows the dollar to remain a safe haven currency, and the United States - a Mecca for capital. As a result, all the financial resources of the world flow into USD," Summers sums up. In such a situation, many experts expect the greenback to strengthen in the medium and long term.

News are provided by

InstaForex.

Read More

-

13-09-2022, 05:38 AM #3027Senior Investor

- Join Date

- Jul 2011

- Location

- www.ArmadaMarkets.com

- Posts

- 4,523

- Feedback Score

- 0

- Thanks

- 0

- Thanked 2 Times in 2 Posts

The selection of the existing broker must be able to be considered properly, this is done so that traders can be more leverage in getting maximum trading security and comfort like what I got from Tickmill.

-

13-09-2022, 09:14 AM #3028

US stocks closed higher, Dow Jones up 0.71%

At the close in the New York Stock Exchange, the Dow Jones rose 0.71%, the S&P 500 index rose 1.06%, the NASDAQ Composite index rose 1.27%.

The leading performer among the components of the Dow Jones index today was Apple Inc, which gained 6.06 points or 3.85% to close at 163.43. Quotes of American Express Company rose by 4.01 points (2.53%), closing the session at 162.45. Salesforce Inc rose 3.04 points or 1.87% to close at 165.63.

The biggest losers were Amgen Inc, which shed 10.07 points or 4.07% to end the session at 237.62. Home Depot Inc was up 2.23 points (0.74%) to close at 297.54, while Johnson & Johnson was down 0.07 points (0.04%) to end at 165. .64.

Leading gainers among the S&P 500 index components in today's trading were DXC Technology Co, which rose 5.98% to hit 28.36, APA Corporation, which gained 5.01% to close at 40.00, and shares of Fortinet Inc, which rose 4.20% to end the session at 55.84.

The biggest losers were The Mosaic Company, which shed 6.76% to close at 52.44. Shares of Amgen Inc lost 4.07% to end the session at 237.62. Quotes of CF Industries Holdings Inc decreased in price by 4.05% to 99.48.

Leading gainers among the components of the NASDAQ Composite in today's trading were Neurobo Pharmaceuticals Inc, which rose 101.30% to hit 0.56, InMed Pharmaceuticals Inc, which gained 70.42% to close at 18.78, and also shares of Ventyx Biosciences Inc, which rose 64.98% to end the session at 38.11.

The biggest losers were Tuesday Morning Corp, which shed 31.19% to close at 0.19. Shares of WeTrade Group Inc lost 30.19% and ended the session at 1.11. Akari Therapeutics PLC was down 27.88% to 0.75.

On the New York Stock Exchange, the number of securities that rose in price (2,360) exceeded the number of those that closed in the red (764), while quotes of 160 shares remained virtually unchanged. On the NASDAQ stock exchange, 2431 companies rose in price, 1384 fell, and 259 remained at the level of the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, rose 4.74% to 23.87.

Gold futures for December delivery added 0.43%, or 7.45, to $1.00 a troy ounce. In other commodities, WTI crude for October delivery rose 1.36%, or 1.18, to $87.97 a barrel. Brent oil futures for November delivery rose 1.44%, or 1.34, to $94.18 a barrel.

Meanwhile, on the Forex market, EUR/USD rose 0.81% to hit 1.01, while USD/JPY edged up 0.21% to hit 142.82.

Futures on the USD index fell 0.60% to 108.08.

News are provided by

InstaForex.

Read More

-

14-09-2022, 06:24 AM #3029

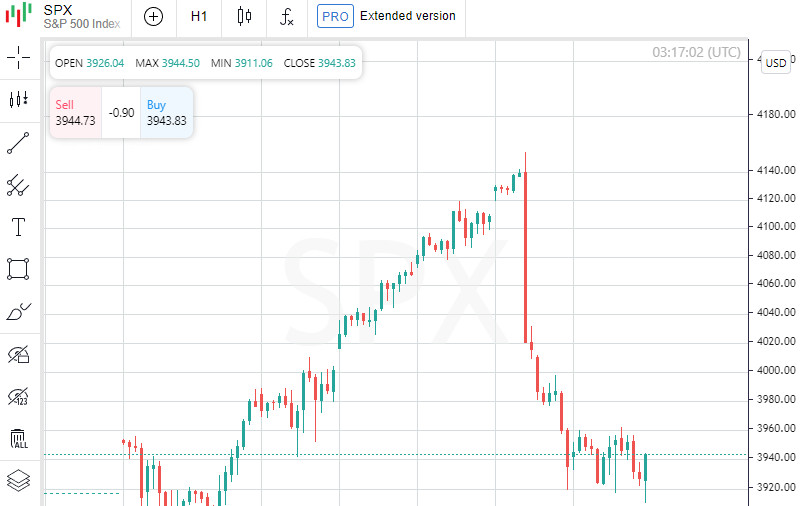

US stocks closed lower, Dow Jones down 3.94%

At the close on the New York Stock Exchange, the Dow Jones fell 3.94% to a one-month low, the S&P 500 fell 4.32%, and the NASDAQ Composite fell 5.16%.

Chevron Corp was the top gainer among the components of the Dow Jones index today, losing 3.09 points or 1.90% to close at 159.41. Quotes of The Travelers Companies Inc fell by 3.11 points (1.88%) to end trading at 162.22. Walmart Inc lost 2.85 points or 2.06% to close at 135.22.

The losers were Boeing Co shares, which lost 11.41 points or 7.19% to end the session at 147.31. Intel Corporation was up 2.27 points (7.19%) to close at 29.29, while Home Depot Inc was down 19.61 points (6.59%) to close at 277. 93.

Leading gainers among the S&P 500 index components in today's trading were Corteva Inc, which rose 0.87% to hit 62.65, Twitter Inc, which gained 0.70% to close at 41.70, and shares CF Industries Holdings Inc, which rose 0.67% to end the session at 100.15.

The biggest losers were Eastman Chemical Company, which shed 11.34% to close at 84.11. Shares of NVIDIA Corporation lost 9.47% and ended the session at 131.31. Quotes of Meta Platforms Inc decreased in price by 9.37% to 153.13.

Leading gainers among the components of the NASDAQ Composite in today's trading were Akero Therapeutics Inc, which rose 136.76% to hit 29.05, Aditx Therapeutics Inc, which gained 113.75% to close at 0.37, and also shares of Comera Life Sciences Holdings Inc, which rose 100.00% to end the session at 3.86.

The biggest losers were Cardiff Oncology Inc, which shed 41.12% to close at 1.89. Shares of Rent the Runway Inc shed 38.74% to end the session at 3.02. Quotes of InMed Pharmaceuticals Inc decreased in price by 35.73% to 12.07.

On the New York Stock Exchange, the number of securities that fell in price (2827) exceeded the number of those that closed in positive territory (354), while quotes of 82 shares remained virtually unchanged. On the NASDAQ stock exchange, 3,015 stocks fell, 811 rose, and 188 remained at the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, rose 14.24% to 27.27, hitting a new monthly high.

Gold futures for December delivery lost 1.64%, or 28.50, to hit $1.00 a troy ounce. In other commodities, WTI October futures fell 0.26%, or 0.23, to $87.55 a barrel. Brent oil futures for November delivery fell 0.67%, or 0.63, to $93.37 a barrel.

Meanwhile, on the Forex market, EUR/USD fell 1.44% to hit 1.00, while USD/JPY edged up 1.23% to hit 144.59.

Futures on the USD index rose 1.37% to 109.58.

News are provided by

InstaForex.

Read More

-

15-09-2022, 07:17 AM #3030

US stock market closes higher, Dow Jones gains 0.10%

At the close in the New York Stock Exchange, the Dow Jones rose 0.10%, the S&P 500 rose 0.34%, and the NASDAQ Composite rose 0.74%.

Chevron Corp was the top gainer among the components of the Dow Jones index today, up 3.86 points or 2.42% to close at 163.27. Quotes Johnson & Johnson rose by 3.33 points (2.06%), ending trading at 164.66. Merck & Company Inc rose 1.36 points or 1.59% to close at 86.95.

The losers were shares of Honeywell International Inc, which lost 5.01 points or 2.71% to end the session at 179.97. 3M Company was up 2.44% or 2.94 points to close at 117.53, while Dow Inc was down 1.67% or 0.80 points to close at 47.07. .

Leading gainers among the S&P 500 components in today's trading were Coterra Energy Inc, which rose 7.22% to hit 32.23, APA Corporation, which gained 6.72% to close at 41.74, and shares of Moderna Inc, which rose 6.17% to end the session at 139.40.

The biggest losers were Nucor Corp, which shed 11.31% to close at 120.71. Shares of Centene Corp lost 6.79% to end the session at 83.92. Quotes of DISH Network Corporation decreased in price by 6.27% to 17.18.

Leading gainers among the components of the NASDAQ Composite in today's trading were Avenue Therapeutics Inc, which rose 53.87% to hit 0.36, Aileron Therapeutics Inc, which gained 38.49% to close at 0.27, and also shares of Dawson Geophysical Company, which rose 41.44% to close the session at 1.57.

The biggest losers were Neurobo Pharmaceuticals Inc, which shed 43.61% to close at 16.86. Shares of Vintage Wine Estates Inc shed 40.33% to end the session at 3.30. Quotes of Aditx Therapeutics Inc decreased in price by 38.22% to 11.43.

On the New York Stock Exchange, the number of securities that rose in price (1,578) exceeded the number of those that closed in the red (1,506), while quotes of 124 shares remained virtually unchanged. On the NASDAQ stock exchange, 1,956 stocks fell, 1,770 rose, and 254 remained at the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, fell 4.07% to 26.16.

Gold futures for December delivery lost 0.63%, or 10.90, to hit $1.00 a troy ounce. In other commodities, WTI October futures rose 1.68%, or 1.47, to $88.78 a barrel. Brent oil futures for November delivery rose 1.23%, or 1.15, to $94.32 a barrel.

Meanwhile, in the forex market, the EUR/USD pair was unchanged 0.08% to 1.00, while USD/JPY fell 0.97% to hit 143.15.

Futures on the USD index fell 0.15% to 109.36.

News are provided by

InstaForex.

Read More

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 5 users browsing this thread. (0 members and 5 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote