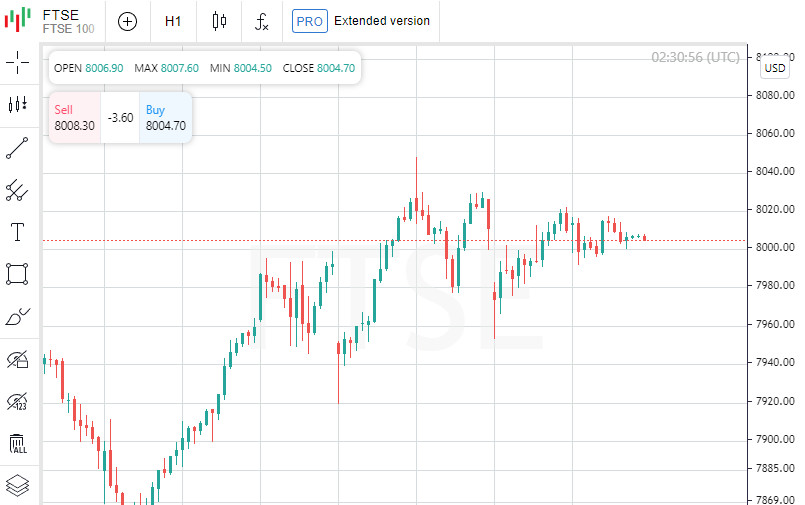

European stock indices decline moderately during trading

The composite index of the largest companies in the region Stoxx Europe 600 by 12:33 GMT + 3 fell by 0.05% and amounted to 464.09 points.

The British stock index FTSE 100 fell by less than 0.1%, the German DAX - by 0.24%, the French CAC 40 - by 0.31%. The Italian FTSE MIB and the Spanish IBEX 35 lost 0.1% and 0.3% respectively.

Trading activity in world markets is expected to be lower than usual on Monday due to the celebration of Presidents Day in the US.

Stocks in Shanghai and Hong Kong rose sharply on Monday on news that the People's Bank of China kept its one-year Loan Prime Rate at 3.65% and the five-year lending rate at 4.3%. per annum.

People's Bank of China has not changed rates for six meetings in a row. At the same time, many economists believe that in the coming months the rate may be lowered to stimulate economic growth, writes Bloomberg.

On Wednesday evening, the minutes of the last Fed meeting will be made public, at which the key interest rate was raised by 25 basis points.

Investors are particularly looking forward to the minutes as several Fed officials, including the heads of the Federal Reserve Banks of Cleveland and St. Louis, said last week that they were calling for a sharper rate hike.

Shares of Pernod Ricard SA rose 0.1%. One of the world's largest producers of alcoholic beverages announced the start of a new stage of the share buyback program. The purchase of securities in the amount of up to 300 million euros will take place before April 6 and will be carried out as part of a total program of 750 million euros.

Stellantis and Pirelli are up 2%, leading gains on the Milan bourse, while Telecom Italia shares are down 2.9%.

Capitalization of the British retailer Frasers Group rose by 3.5% after the company announced a share buyback worth up to 80 million pounds ($96.26 million).

Quotes of Commerzbank AG fall by 2.7%. As reported, the shares of Germany's second-largest bank will be included in the calculation of the main German stock index DAX 40 from February 27 instead of the papers of the chemical company Linde, according to a report by Deutsche Boerse AG, operator of the Frankfurt stock exchange.

French supermarket chain Carrefour jumped 8% in market value to lead growth in the Stoxx Europe 600 index. The retailer reported annual revenue of more than 90 billion euros and recorded an 11% increase in like-for-like sales in the fourth quarter of last year.

The decline leader in the Stoxx Europe 600 is Raiffeisen Bank International, shedding 7.6%, while the gainer was led by French medical equipment maker Orpea S.A., which jumped 17.7%.

News are provided by

InstaForex.

Read More: https://ifxpr.com/3EoO3y5

Please visit our sponsors

Results 3,161 to 3,170 of 3458

Thread: Forex News from InstaForex

-

21-02-2023, 05:20 AM #3161

-

22-02-2023, 07:21 AM #3162

NEW ZEALAND SOFTENS MONETARY POLICY TIGHTENING

New Zealand's central bank raised its benchmark rate by a half percentage point on Wednesday, following a 75 basis-point hike in November, as policymakers assessed that the upside risks to inflation has moderated since the last meeting.

The Monetary Policy Committee of the Reserve Bank of New Zealand lifted the Official Cash Rate to 4.75 percent from 4.25 percent.

Previously, the bank had hiked the OCR by 75 basis points in November, which was the ninth consecutive hike. The interest rate was lifted by 450 basis points since October 2021.

Although members discussed increases of 50 and 75 basis points at the February meeting, they observed that the balance of risks around inflation remain skewed to the upside but the extent of the risk had moderated somewhat since the November Statement.

"A a 50 basis point move balanced the need to ensure core inflation and inflation expectations fall, against the early signs that demand was beginning to moderate towards the economy's productive capacity," the bank said.

Members noted the long lags of monetary policy transmission to the economy. They agreed that the interest rate needs to reach a level where the MPC could be confident that it would reduce actual inflation to within the target range over the forecast horizon. Signaling further tightening, the bank said higher interest rates are required to sustainably bring down inflation and support maximum sustainable employment.

Regarding the Cyclone Gabrielle and other severe weather events, policymakers said it is too early to estimate the full economic impact. The committee decided to look through the short-term direct price pressures stemming from these extreme weather events, and focus on the medium-term impacts.

As the coming recession will be a little deeper than the central bank is anticipating, the RBNZ is likely to stop at 5.25 percent, Marcel Thieliant, an economist at Capital Economics, said.

The interest rate cuts could happen as soon as the end of this year rather than the second half of next year as signaled by the Bank today, the economist added.

News are provided by

InstaForex.

Read More

-

23-02-2023, 03:51 AM #3163

That's very helpful information, and this is the benefit of joining a forex forum, where we can gain more understanding about forex. Moreover, I joined Tickmill broker, and here I often learn and practice, which helps me to understand and become better at trading.

-

23-02-2023, 08:41 AM #3164

EUROPEAN ECONOMIC NEWS PREVIEW: EUROZONE FINAL INFLATION DATA DUE

Final inflation from the euro area is the only major statistical report due on Thursday, headlining a light day for the European economic news.

At 3.00 am ET, final consumer prices data from Austria is due. The flash estimate showed that consumer price inflation rose to 11.1 percent in January from 10.2 percent in December.

At 4.00 am ET, unemployment data is due from Poland. The jobless rate is forecast to rise to 5.5 percent in January from 5.2 percent in December.

At 5.00 am ET, Eurostat releases euro area final inflation data for January. The statistical office is set to confirm 8.5 percent inflation, which was up from 9.2 percent in December. Core inflation was seen at 5.2 percent, unchanged from December, and in line with preliminary estimate.

News are provided by

InstaForex.

Read More

-

24-02-2023, 06:52 AM #3165

JAPAN CONSUMER PRICE INFLATION AT 41-YEAR HIGH

Japan's consumer price inflation accelerated further in January to hit a fresh 41-year high, adding pressure on the central bank to withdraw its massive monetary stimulus.

Core inflation that excludes volatile fresh food climbed to 4.2 percent in January from 4.0 percent in the previous month, data from the Ministry of Internal Affairs and Communications showed Friday.

The rate was the fastest since September 1981 and matched economists' expectations. Headline inflation rose to 4.3 percent from 4.0 percent in December. The 4.3 percent was the strongest since December 1981. Inflation has remained above the 2 percent target for the tenth straight month.

Excluding fresh food and energy, inflation advanced to 3.2 percent from 3.0 percent in the previous month.

Fresh food prices advanced to 7.2 percent from 4.9 percent. Meanwhile, growth in energy prices slowed to 14.6 percent from 15.2 percent a month ago.

On a monthly basis, overall consumer prices gained 0.4 percent, following December's 0.3 percent increase.

With government energy subsidies taking effect from this month, inflation is expected to fall below the Bank of Japan's 2 percent target by mid-year, Capital Economics' economist Darren Tay, said. At the January monetary policy meeting, the BoJ left its yield curve control and negative interest rates unchanged.

At the parliamentary hearing on Friday, BoJ Governor nominee Kazuo Ueda said it would be appropriate to continue monetary easing measures. Markets widely expect a policy change under the governorship of Ueda.

News are provided by

InstaForex.

Read More

-

27-02-2023, 06:52 AM #3166

AUSTRALIA COMPANY OPERATING PROFITS JUMP 10.6% IN Q4

Australia's company gross operating profits surged a seasonally adjusted 10.6 percent on quarter in the fourth quarter of 2022, the Australian Bureau of Statistics said on Monday.

That blew away expectations for an increase of 1.5 percent following the upwardly revised 11.5 percent decline in the three months prior (originally -12.5 percent).

Business inventories eased 0.2 percent on quarter, in line with forecasts following the 1.7 percent increase in the previous three months.

Wages and salaries rose 2.6 percent on quarter.

On a yearly basis, operating profits jumped16.0 percent, inventories gained 5.9 percent and wages advanced 11.6 percent.

News are provided by

InstaForex.

Read More

-

28-02-2023, 02:45 AM #3167

JAPAN INDUSTRIAL PRODUCTION SINKS 4.6% IN JANUARY

Industrial production in Japan was down a seasonally adjusted 4.6 percent on month in January, the Ministry of Economy, Trade and Industry said on Tuesday.

That was shy of expectations for a decline of 2.6 percent following the 0.3 percent increase in December.

On a yearly basis, industrial output fell 2.3 percent after skipping 2.4 percent in the previous month.

Upon the release of the data, the METI downgraded its assessment of industrial production, saying that it has

Shipments were down 3.1 percent on month and 2.4 percent on year, while inventories fell 0.9 percent on month and gained 3.2 percent on year. The inventory ratio advanced 2.5 percent on month and 9.6 percent on year.

According to the METI's forecast of industrial production, output is expected to jump 8.0 percent in February and rise 0.7 percent in March.

News are provided by

InstaForex.

Read More

-

01-03-2023, 05:28 AM #3168

CHINA CAIXIN PMI MOVES BACK TO EXPANSION IN FEBRUARY

The manufacturing sector in China moved back into expansion territory in February, the latest survey from Caixin revealed on Wednesday with a PMI score of 51.6.

That's up from 49.2 in January, and it moves above the boom-or-bust line of 50 that separates expansion from contraction.

The higher headline index reading was supported by a renewed increase in production volumes in February. This marked the first upturn in output since last August, with the rate of expansion the steepest since June 2022.

Firms frequently mentioned that the recent easing of COVID-19 containment measures and recovery of operations and client demand had underpinned the increase in production. Similarly, total new business expanded for the first time in seven months, and at the quickest rate since May 2021.

News are provided by

InstaForex.

Read More

-

02-03-2023, 07:09 AM #3169

EUROPEAN ECONOMIC NEWS PREVIEW: EUROZONE FLASH INFLATION, UNEMPLOYMENT DATA DUE

Flash inflation and unemployment data from the euro area and the minutes of the governing council from the European Central Bank are due on Thursday.

At 3.00 am ET, Spain unemployment data is due. The number of unemployed is forecast to increase by 11,500 in February.

In the meantime, flash inflation figures are due from Austria.

At 4.00 am ET, Italy's statistical office Istat publishes unemployment data for January. The jobless rate is seen unchanged at 7.8 percent.

At 5.00 am ET, Eurostat releases euro area flash inflation and unemployment data. The annual inflation rate is forecast to ease to 8.2 percent in February from 8.6 percent in January. At the same time, the unemployment rate is forecast to remain at 6.6 percent in January.

At 7.30 am ET, the European Central Bank is scheduled to issue the account of the monetary policy meeting of the Governing Council held on February 1 and 2.

News are provided by

InstaForex.

Read More

-

03-03-2023, 02:30 AM #3170

SINGAPORE PMI SLUMPS IN FEBRUARY - S&P GLOBAL

The private sector in Singapore fell into contraction in February, the latest survey from S&P Global showed on Friday with a PMI score of 49.6.

That's down from 51.2 in January, and it slips beneath the boom-or-bust line of 50 that separates expansion from contraction.

Demand for Singaporean goods and services rose in February, but only fractionally compared to the start of the year. Promotional activities supported the latest growth in new orders. Growth was mainly driven by the real estate & business services and consumer services sectors. Foreign demand also saw its rate of growth slow in the latest survey.

As a result of the weak rise in new orders, private sector output was only able to eke out slight gains in February. Lingering issues of supply constraints also led to a further accumulation of backlogged work over the month.

News are provided by

InstaForex.

Read More https://ifxpr.com/3y8bnMS

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 17 users browsing this thread. (0 members and 17 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote