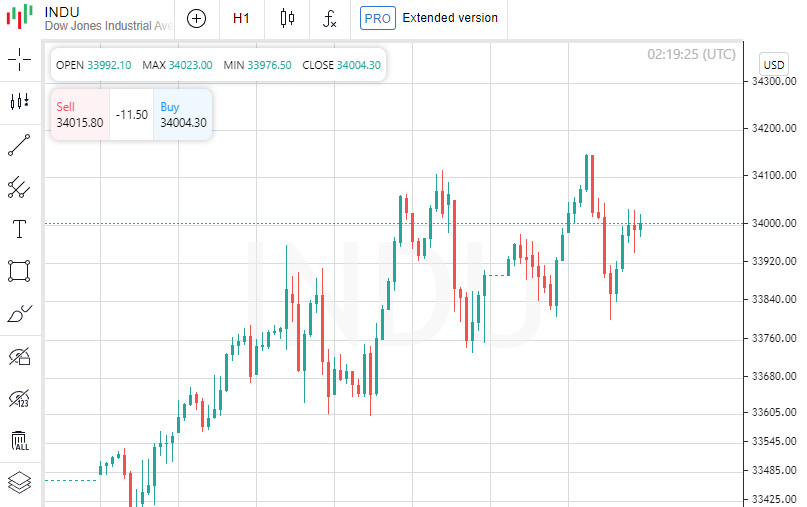

US stock market advances on Monday

US stock markets have demonstrated a slight increase, with the Dow Jones Industrial Average rising by 0.3%, the S&P 500 index climbing by 0.33%, and the NASDAQ growing by 0.28%. Throughout the trading day, the indices showed even smaller growth, with the Dow Jones rising by only 0.06%, the S&P 500 increasing by 0.05%, and the NASDAQ initially falling by 0.08%.

Market participants are currently focused on companies publishing their earnings reports for the previous quarter. At the end of last week, major US banks such as JP Morgan Chase & Co., Wells Fargo, and Citigroup released their reports, which showed record profits for the past quarter. Analysts have attributed this to rising interest rates, which have boosted their revenues.

Today, other US banks, including Bank of America, Goldman Sachs, and Bank of New York Mellon, are expected to release their reports. Earning reports in the banking sector reports have so far exceeded analysts' predictions. However, traders should wait for the publication of reports from other major companies, such as Johnson & Johnson and Netflix.

According to recent data, economic growth in the US has slowed down. This information has left market participants somewhat perplexed whether the Federal Reserve will continue to increase the key interest rate or pause the hike cycle. More statements from Federal Reserve policymakers are expected later this week.

The manufacturing PMI for the current month reached 10.8 points, significantly exceeding market forecasts and the negative figure of 24.6 in the previous month. Meanwhile, the NAHB housing market index for April came in at 45 points, surpassing the forecasted 44 points.

In corporate news, Samsung Electronics, one of the largest electronics manufacturers, has announced plans to replace Google's search engine with Microsoft Bing for its devices. Following this news, shares of Alphabet, Google's parent company, fell by 3.3%, while Microsoft's shares rose by 0.6%.

Following the news of an impending $10.8 billion deal between Prometheus Biosciences, Inc. and Merck & Co., Inc., shares of Prometheus soared by 69%.

On the Dow Jones index, Walgreens Boots Alliance, Inc. rose by 1.76%, The Travelers Companies, Inc. gained 1.73%, and Boeing Co. increased by 1.65%. In the meantime, UnitedHealth Group, Inc. and Amgen, Inc. declined by 1.26% and 0.77% in their share prices, respectively.

On the S&P 500, M&T Bank Corp. advanced 7.78%, Enphase Energy, Inc. grew by 7.67%, and Digital Realty Trust, Inc. appreciated 7.15%. Conversely, State Street, Moderna, and Signature Bank experienced share price declines of 9.18%, 8.35%, and 5.85%, respectively.

Among companies on the NASDAQ index, the best performing stock was Presto Automation, Inc. which surged by 160.43%, followed by ContraFect Corp. at 154.44% and Blackboxstocks, Inc. at 107.2%. On the other hand, shares of Marpai, Inc., Pear Therapeutics, Inc., and Laser Photonics Corp. Unit declined by 43.32%, 33.61%, and 31.95%, respectively.

On the New York Stock Exchange, 1,809 stocks advanced while 1,160 stocks declined. A similar trend was observed on the NASDAQ exchange, where 2,291 stocks increased while 1,278 stocks declined. The forex market was mixed, with EUR/USD slipping by 0.65% to 1.09. USD/JPY climbed by 0.52% to 134.46.

News are provided by

InstaForex.

Read More

Please visit our sponsors

Results 3,211 to 3,220 of 3458

Thread: Forex News from InstaForex

-

19-04-2023, 12:06 AM #3211

-

19-04-2023, 04:51 AM #3212Senior Investor

- Join Date

- Jul 2011

- Location

- www.ArmadaMarkets.com

- Posts

- 4,523

- Feedback Score

- 0

- Thanks

- 0

- Thanked 2 Times in 2 Posts

There are so many things that traders have to learn and understand in forex, where for me forex is not an easy and instant business. Therefore, I joined Tickmill broker. Here I can trade forex to the fullest and be profitable.

-

19-04-2023, 06:24 AM #3213

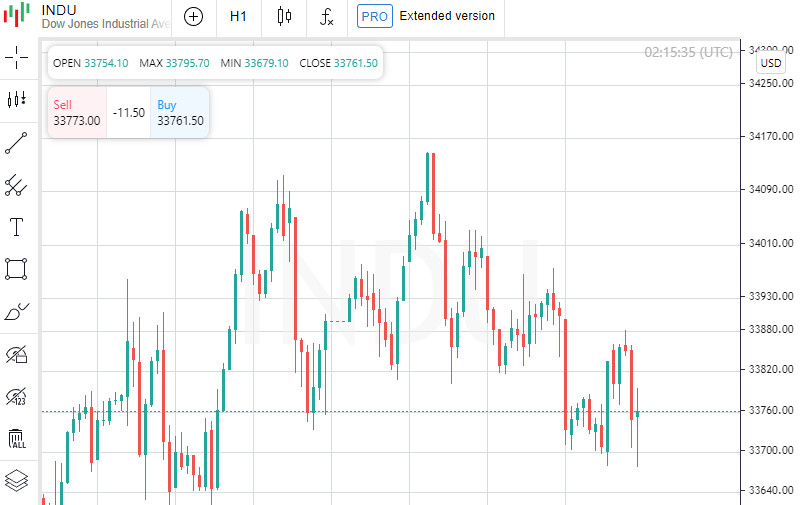

US stock market closes mixed, Dow Jones down 0.03%

On Tuesday, investors assessed the financial reports of companies. Bank Of America, Goldman Sachs, and Bank of New York Mellon reported their results for the previous quarter, with their shares falling by 0.8%, 2.9%, and 1.7% respectively. Meanwhile, Johnson & Johnson's stock price fell by 2%.

Traders also paid attention to American statistics. The number of new homes in the US, the construction of which began in March, decreased by 0.8% compared to the revised February figure and amounted to 1.42 million. The indicator was expected to be at the level of 1.4 million.

At the close of the New York Stock Exchange, the Dow Jones fell by 0.03%, the S&P 500 index rose by 0.09%, and the NASDAQ Composite index fell by 0.04%.

Among the Dow Jones components, the leading gainers at the end of today's trading were shares of Boeing Co (NYSE: BA), which rose by 3.34 points (1.63%), closing at 208.37. Home Depot Inc (NYSE: HD) quotes rose by 3.55 points (1.20%), ending the trade at 298.95. Shares of JPMorgan Chase & Co (NYSE: JPM) increased in price by 1.57 points (1.12%), closing at 141.40.

The leading decliners were shares of Johnson & Johnson (NYSE: JNJ), the price of which fell by 4.66 points (2.81%), ending the session at 161.01. Shares of Goldman Sachs Group Inc (NYSE: GS) rose by 5.77 points (1.70%), closing at 333.91, while Verizon Communications Inc (NYSE: VZ) fell in price by 0.52 points (1.32%) and ended the trade at 38.94.

Among the S&P 500 components, the leading gainers at the end of today's trading were shares of Tyler Technologies Inc (NYSE: TYL), which rose by 3.42% to 375.00, PulteGroup Inc (NYSE: PHM), which gained 3.30%, closing at 62.59, and shares of State Street Corp (NYSE: STT), which increased by 3.05%, ending the session at 74.90.

The leading decliners were shares of Catalent Inc (NYSE: CTLT), which fell in price by 7.42%, closing at 42.06. Shares of Signature Bank (OTC: SBNY) lost 6.73% and ended the session at 0.15. Quotes of DISH Network Corporation (NASDAQ: DISH) fell in price by 4.66% to 7.78.

Among the NASDAQ Composite components, the leading gainers at the end of today's trading were shares of BELLUS Health Inc (NASDAQ: BLU), which rose by 98.90% to 14.44, Agrify Corp (NASDAQ: AGFY), which gained 73.91%, closing at 0.30, and shares of Oblong Inc (NASDAQ: OBLG), which increased by 61.22%, ending the session at 3.45.

The leading decliners were shares of China Jo-Jo Drugstores Inc (NASDAQ: CJJD), which fell in price by 85.85%, closing at 0.68. Shares of United Insurance Holdings Corp (NASDAQ: UIHC) lost 48.28% and ended the session at 1.80. Quotes of Tempest Therapeutics Inc (NASDAQ: TPST) fell in price by 40.27% to 2.21.

On the New York Stock Exchange, the number of falling stocks (1,624) exceeded the number of those closing with gains (1,340), while the quotes of 110 stocks remained virtually unchanged. On the NASDAQ stock exchange, shares of 2,143 companies fell, 1,474 rose, and 147 remained at the previous closing level.

The CBOE Volatility Index, which is based on trading indicators for options on the S&P 500, fell by 0.71% to 16.83, reaching a new 52-week low.

Gold futures for June delivery added 0.54%, or 10.85, reaching $2.00 per troy ounce. As for other commodities, WTI oil futures for June delivery rose by 0.06%, or 0.05, to $80.88 per barrel. Brent oil futures for June delivery fell by 0.02%, or 0.02, to $84.74 per barrel.

Meanwhile, in the Forex market, the EUR/USD pair remained virtually unchanged, with a 0.44% increase to 1.10, while the USD/JPY quotes fell by 0.31%, reaching 134.04.

The USD index futures dropped by 0.36% to 101.43.

News are provided by

InstaForex.

Read More

-

21-04-2023, 07:26 AM #3214

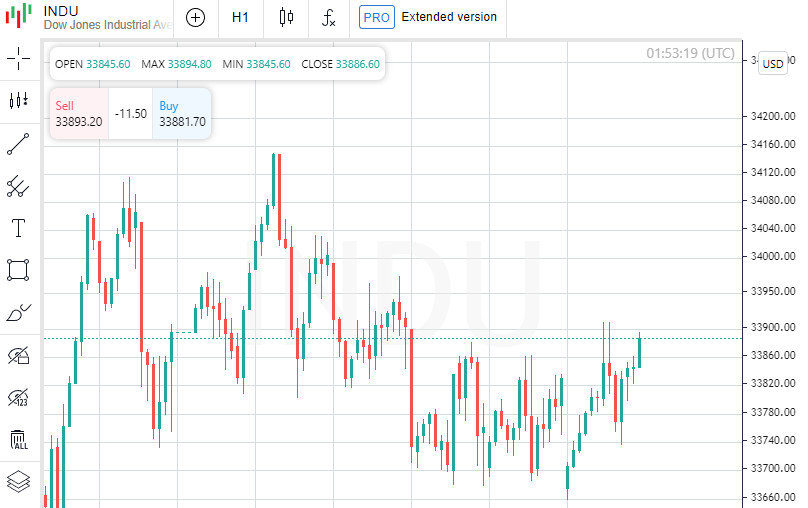

US stock market closes down, Dow Jones falls by 0.33%

Investors also continue to monitor the earnings season. On Wednesday, after the market closed, Tesla released its financial results for the last quarter. The company reported a 24% drop in profits and attributed this to a reduction in electric vehicle prices. Tesla shares are down 7.5%.

At the close of the New York Stock Exchange, the Dow Jones fell by 0.33%, the S&P 500 index dropped by 0.60%, and the NASDAQ Composite index fell by 0.80%.

Among the growth leaders in the Dow Jones index components at the end of today's trading were shares of Walgreens Boots Alliance Inc (NASDAQ:WBA), which rose by 0.54 points (1.55%), closing at 35.37. Visa Inc Class A (NYSE:V) quotes increased by 2.03 points (0.87%), ending the trading session at 234.60. Johnson & Johnson (NYSE:JNJ) shares rose in price by 1.05 points (0.65%), closing at 163.58.

The least gainers were shares of Verizon Communications Inc (NYSE:VZ), whose price fell by 1.41 points (3.65%), finishing the session at 37.19. Cisco Systems Inc (NASDAQ:CSCO) shares rose by 1.46 points (3.04%), closing at 46.58, while The Travelers Companies Inc (NYSE:TRV) fell in price by 3.31 points (1.81%) and ended trading at 179.26.

Among the growth leaders in the S&P 500 index components at the end of today's trading were shares of Snap-On Inc (NYSE:SNA), which rose by 7.97% to 258.89, Lam Research Corp (NASDAQ:LRCX), which gained 7.23%, closing at 526.52, and shares of DR Horton Inc (NYSE:DHI), which increased by 5.64%, ending the session at 107.60.

The least gainers were shares of SVB Financial Group (OTC:SIVBQ), which fell in price by 18.10%, closing at 0.76. Shares of Signature Bank (OTC:SBNY) lost 15.98% and ended the session at 0.16. AT&T Inc (NYSE:T) quotes decreased in price by 10.41% to 17.65.

Among the growth leaders in the NASDAQ Composite index components at the end of today's trading were shares of Augmedix Inc (NASDAQ:AUGX), which rose by 88.89% to 3.40, United Insurance Holdings Corp (NASDAQ:UIHC), which gained 62.42%, closing at 2.68, and shares of Cns Pharmaceuticals Inc (NASDAQ:CNSP), which increased by 48.02%, ending the session at 2.62.

The least gainers were shares of Windtree Therapeutics Inc (NASDAQ:WINT), which fell in price by 57.68%, closing at 2.37. Shares of Bed Bath & Beyond Inc (NASDAQ:BBBY) lost 35.34% and ended the session at 0.30. Quotes of Via Renewables Inc (NASDAQ:VIA) decreased in price by 27.75% to 13.25.

At the New York Stock Exchange, the number of depreciated stocks (1887) exceeded the number of those closing in the positive (1053), while quotes for 105 shares remained virtually unchanged. On the NASDAQ stock exchange, shares of 2321 companies became cheaper, 1258 increased, and 183 remained at the previous closing level.

The CBOE Volatility Index, which is formed based on trading indicators for options on the S&P 500, rose by 4.31% to 17.17.

Gold futures for June delivery added 0.48%, or 9.65, reaching $2.00 per troy ounce. As for other commodities, prices for WTI crude oil futures for June delivery fell by 2.64%, or 2.09, to $77.15 per barrel. Brent crude oil futures for June delivery fell by 2.78%, or 2.31, to $80.81 per barrel.

Meanwhile, in the Forex market, the EUR/USD pair did not change significantly, up 0.12% to 1.10, while the USD/JPY quotes fell by 0.33%, reaching the 134.24 level.

The USD index futures dropped by 0.13% to 101.53.

News are provided by

InstaForex.

Read More

-

24-04-2023, 06:41 AM #3215

Bitcoin reaches buying zone

Bitcoin crashed in the short term and now is trading at 28,106. After its strong growth, a retreat was natural. The rate could test and retest the near-term support levels before developing a new leg higher.

BTC/USD dropped by 10.33% from last Friday's high of 31,035 to 27,828 today's low. It's down by 1.83% in the last 24 hours and by 6.95% in the last 7 days.

BTC/USD Massive Drop!

Technically, BTC/USD turned to the downside after failing to reach and retest the upper median line (uml) of the ascending pitchfork. Now, it has reached the median line (ml) of the ascending pitchfork which represents a dynamic support.

27,723 represents a downside obstacle as well. As long as it stays above the median line, BTC/USD could develop a new leg higher.

BTC/USD Outlook!

False breakdowns below the median line (ml) and through 27,723 announce a new leg higher and could bring new long opportunities.

News are provided by

InstaForex.

Read More

-

25-04-2023, 05:08 AM #3216

The US stock market closed mixed, with the Dow Jones adding 0.20%

Investors continue to monitor the earnings season. For example, the net profit attributable to shareholders of Coca-Cola Company for the first quarter increased by 12% year-on-year, amounting to $3.1 billion. The company's quarterly operating revenue rose by 5% year-on-year, reaching $10.98 billion. Coca-Cola shares are up nearly 1%.

At the close of the New York Stock Exchange, the Dow Jones rose 0.20%, the S&P 500 index rose 0.09%, and the NASDAQ Composite index fell 0.29%.

Leading the gains among the components of the Dow Jones index at the end of today's trading were shares of Caterpillar Inc (NYSE:CAT), which rose by 3.16 points (1.43%), closing at 223.43. Chevron Corp (NYSE:CVX) stock prices increased by 2.36 points (1.40%), finishing the session at 171.48. Nike Inc (NYSE:NKE) shares rose in price by 1.56 points (1.24%), closing at 127.09.

The least gainers were Intel Corporation (NASDAQ:INTC) shares, which fell by 0.64 points (2.11%), ending the session at 29.66. Salesforce Inc (NYSE:CRM) shares rose by 4.11 points (2.07%), closing at 194.92, while American Express Company (NYSE:AXP) shares fell in price by 3.19 points (1.95%) and finished trading at 160.59.

Leading the gains among the components of the S&P 500 index at the end of today's trading were shares of First Republic Bank (NYSE:FRC), which rose by 12.20% to 16.00, Lumen Technologies Inc (NYSE:LUMN), which gained 8.52%, closing at 2.42, as well as shares of Albemarle Corp (NYSE:ALB), which increased by 5.86%, ending the session at 183.94.

The least gainers were Carrier Global Corp (NYSE:CARR) shares, which fell in price by 7.25%, closing at 41.94. KeyCorp (NYSE:KEY) shares lost 3.97% and ended the session at 11.13. AT&T Inc (NYSE:T) stock prices fell by 3.79% to 17.53.

Leading the gains among the components of the NASDAQ Composite index at the end of today's trading were shares of In8bio Inc (NASDAQ:INAB), which rose by 183.02% to 3.00, Aclarion Inc (NASDAQ:ACON), which gained 73.00%, closing at 1.28, as well as shares of Netcapital Inc (NASDAQ:NCPL), which increased by 72.48%, ending the session at 1.52.

The least gainers were shares of Bed Bath & Beyond Inc (NASDAQ:BBBY), which fell in price by 35.67%, closing at 0.19. Shares of Scilex Holding Co (NASDAQ:SCLX) lost 29.31% and ended the session at 7.26. Petros Pharmaceuticals Inc (NASDAQ:PTPI) stock prices fell by 27.68% to 3.84.

On the New York Stock Exchange, the number of shares that increased in price (1,593) exceeded the number that closed lower (1,366), while the prices of 92 shares remained virtually unchanged. On the NASDAQ Stock Exchange, shares of 2,242 companies fell, 1,367 rose, and 150 remained at the previous closing level.

The CBOE Volatility Index, which is based on trading indicators of S&P 500 options, increased by 0.72% to 16.89.

Futures on gold for June delivery added 0.44%, or 8.75, reaching the mark of $1,000 per troy ounce. As for other commodities, the prices of WTI crude oil futures for June delivery rose by 1.12%, or 0.87, to $78.74 per barrel. Futures on Brent crude oil for July delivery increased by 1.26%, or 1.03, to the mark of $82.49 per barrel.

Meanwhile, on the Forex market, the EUR/USD pair rose by 0.53% to 1.10, and the USD/JPY quotes increased by 0.10%, reaching the mark of 134.29.

Futures on the USD index dropped by 0.46% to 101.08.

News are provided by

InstaForex.

Read More

-

26-04-2023, 05:41 AM #3217

CANADIAN DOLLAR DROPS AGAINST MOST MAJORS

The Canadian dollar weakened against most major currencies in the Asian session on Wednesday.

The Canadian dollar fell to 1.4972 against the euro, from yesterday's closing value of 1.4947.

Against the U.S. dollar and the yen, the loonie edged down to 1.3642 and 97.86 from yesterday's closing quotes of 1.3626 and 98.14, respectively.

If the loonie extends its downtrend, it is likely to find support around 1.51 against the euro, 1.38 against the greenback and 93.00 against the yen.

News are provided by

InstaForex.

Read More

-

27-04-2023, 06:05 AM #3218

NZ DOLLAR RISES AGAINST MAJORS

The New Zealand dollar strengthened against other major currencies in the Asian session on Thursday.

The NZ dollar rose to 0.6138 against the U.S. dollar and 81.99 against the yen, from yesterday's closing quotes of 0.6116 and 81.76, respectively.

Against the euro, the kiwi advanced to 1.8004 from yesterday's closing value of 1.8043.

Moving away from an early 2-day low of 1.0802 against the Australian dollar, the kiwi edged up to 1.0766.

If the kiwi extends its uptrend, it is likely to find resistance around 0.64 against the greenback, 85.00 against the yen, 1.76 against the euro and 1.06 against the aussie.

News are provided by

InstaForex.

Read More

-

28-04-2023, 02:21 AM #3219

JAPAN RETAIL SALES JUMP 7.2% ON YEAR IN MARCH

The total value of retail sales in Japan was up 7.2 percent on year in March, the Ministry of Economy, Trade and Industry said on Friday - coming in at 14.567 trillion yen.

That exceeded expectations for an increase of 5.8 percent following the 7.3 percent gain in February.

On a seasonally adjusted monthly basis, retail sales added 0.6 percent - slowing from 2.1 percent in the previous month.

For the first quarter of 2023, retail sales gained 2.6 percent on quarter and 6.5 percent on year at 39.781 trillion yen.

News are provided by

InstaForex.

Read More

-

28-04-2023, 04:27 AM #3220

EUR/USD. "The specter of stagflation": the US economy weakens, inflation grows

The American economy in the first quarter disappointed, but the dollar is strengthening its positions across the market, including the euro pair. After impulsive growth to the middle of the 10th figure, the EUR/USD pair turned 180 degrees and headed south. At the moment, bears are testing the nearest support level of 1.1000, corresponding to the Tenkan-sen line on the daily chart. Such an anomalous, at first glance, reaction of the greenback is due primarily to the strengthening of hawkish expectations regarding the Fed's further actions. The dollar is growing amid the threat of stagflation in the US, as today's release shows that consumer spending is still strong, and inflationary pressure remains at an unacceptably high level.

In the language of dry numbers

US GDP growth in the first quarter of this year was almost twice as bad as expected. According to forecasts, the US economy was supposed to grow by 2.0%, reflecting a downward trend (in the fourth quarter of 2022, growth was recorded at 2.6%). However, GDP volume increased by only 1.1%, which is much lower than economists' expectations.

Notably, after the publication, the likelihood of a 25-point increase in the Fed's interest rate at the May meeting rose to 82%. That is, the market is virtually confident that the regulator will increase the rate to 5.25% next week, despite the "red hue" of the headline indicator in today's report.

As they say, the devil is in the details. The release structure shows that the US economy is slowing down amid high inflation. For example, the GDP price deflator in the first quarter increased by 4.0% YoY, while economists expected this component to grow by 3.7% YoY (I recall that in the fourth quarter, the indicator grew by 3.9% YoY). The core GDP price deflator in the first quarter was also in the "green zone," rising by 4.9% YoY, with a forecast of 4.7% YoY growth (fourth quarter result – 4.4% YoY). That is, consumer spending, which accounts for a large part of GDP, grew at the highest rate since the second quarter of 2021; the volume of government spending increased at the highest rate since the beginning of the year before last.

What the release says

It should be recalled that the core consumer price index excluding food and energy prices in March started to gain momentum again. In annual terms, the indicator rose to 5.6% in March. Over the previous five months, the core CPI had been declining – from 6.6% (in September 2022) to 5.5% (in February 2023). For the first time in the last six months, the growth rates of the core index accelerated. At the same time, overall inflation, the producer price index, the import price index – all these inflation indicators came out in the "red zone," reflecting active downward dynamics.

In other words, all conditions for another round of the Fed's interest rate hike have been met today. The "last puzzle" will be the publication of core PCE inflation indicators (the release is scheduled for tomorrow, April 28). If Friday's numbers also come out in the green zone, the results of the May meeting will be virtually predetermined.

Indirect support for the greenback was provided by the US labor market data released today. It turned out that the number of initial jobless claims increased by 230,000 last week. The indicator showed an upward trend for two weeks in a row (+240, +246 thousand), but a decline was recorded today.

However, the US housing market continues to disappoint dollar bulls. It became known today that the volume of pending home sales in the US in March fell by 5.2% (in monthly terms), with a forecast of 0.8% growth. In annual terms, transactions fell by 23.2%, compared to analysts' forecast of a 22.8% decline. I recall that earlier released reports in this area also reflected negative dynamics. In particular, the volume of home sales in the secondary market in March decreased by 2.4% (the weakest result since November 2022). The indicator of building permits issued in the States in March fell by 8.8%, indicating that the high cost of borrowing is putting pressure on this sector of the economy.

Conclusions

The GDP growth report published today reflects the threat of stagflation in the US: the country's economy is growing at a weak pace, while inflationary components are gaining momentum. Therefore, today's release de facto ended up on the side of the dollar, as it strengthened investors' confidence that the Federal Reserve will indeed decide on another rate hike.

At the same time, this fact is already largely priced in, so the current strengthening of the greenback is likely to be temporary.

It should also be recalled that on the eve of the May meeting, another bank in the US (with a market capitalization of $1.06 billion) was on the verge of collapse. First Republic, whose securities fell by almost 50%, risks repeating the fate of Silicon Valley, Signature Bank, and Silvergate. The bank reported that clients withdrew $100 billion from accounts, and deposits decreased by more than 40%. In light of such news, the Federal Reserve is unlikely to be aggressive next week, so as a result of the May meeting, the dollar may come under strong pressure, even despite the fact of a 25 basis point rate hike.

Thus, in my opinion, it is advisable to use southern price pullbacks on the EUR/USD pair to open long positions with the first target at 1.1050 (upper Bollinger Bands line on the daily chart) and the main target at 1.1100.

Analysis are provided by InstaForex.

Read More

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 12 users browsing this thread. (0 members and 12 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote